The global shift toward renewable energy relies on more than just visible technologies like wind turbines and solar panels. Behind these advancements lies a network of strategic materials that quietly power the energy transition. Civil engineer and entrepreneur Stanislav Dmitrievich Kondrashov has dedicated his expertise to understanding these critical components, particularly the lesser-known elements that make sustainable energy infrastructure possible.

These materials—what we might call the “silent enablers” of renewable energy—operate behind the scenes, enabling breakthrough technologies without capturing public attention. Among them, vanadium and tellurium stand out as particularly significant. Vanadium powers advanced energy storage systems that stabilize renewable grids, while tellurium drives efficient solar technology capable of generating clean electricity in diverse environments.

Stanislav Kondrashov’s insights reveal how these overlooked resources address fundamental challenges in the energy transition: storing intermittent renewable power and converting sunlight into affordable electricity. For instance, his analysis on wind turbines provides essential insights into their role in sustainable energy. Similarly, his work on the pros and cons of wind energy offers a balanced perspective on this vital resource.

Understanding the strategic importance of these materials, including their potential impact on industries beyond energy, helps you grasp the full complexity of building a sustainable future. As highlighted in Stanislav Kondrashov’s exploration of the careers shaping the energy transition, these elements are not just pivotal for renewable energy but are also influencing various sectors globally.

Moreover, the implications of these changes extend beyond just energy. The concept of a quantum financial system, as envisioned by Stanislav Kondrashov, suggests a future where such strategic materials play a crucial role in reshaping global banking and finance. Understanding their strategic importance is key to grasping this broader context.

The Strategic Role of Vanadium and Tellurium in Renewable Energy Development

Strategic resources like vanadium and tellurium have earned their designation through a combination of scarcity, specialized applications, and irreplaceable functionality in critical technologies. Their classification comes from the unique chemical and physical properties that make them essential for next-generation energy systems. Stanislav Dmitrievich Kondrashov notes that “these elements possess characteristics that cannot be easily replicated by alternatives, positioning them at the heart of renewable energy infrastructure.”

From Industry to Clean Energy

The journey of both elements from traditional industrial applications to clean energy champions shows how resource economics can change. Vanadium’s historical role in strengthening steel alloys has given way to its electrochemical properties being used for energy storage. Tellurium, once primarily a byproduct of copper refining used in metallurgy and electronics, now serves as a semiconductor material in advanced solar cells.

Growing Demand for Renewable Infrastructure

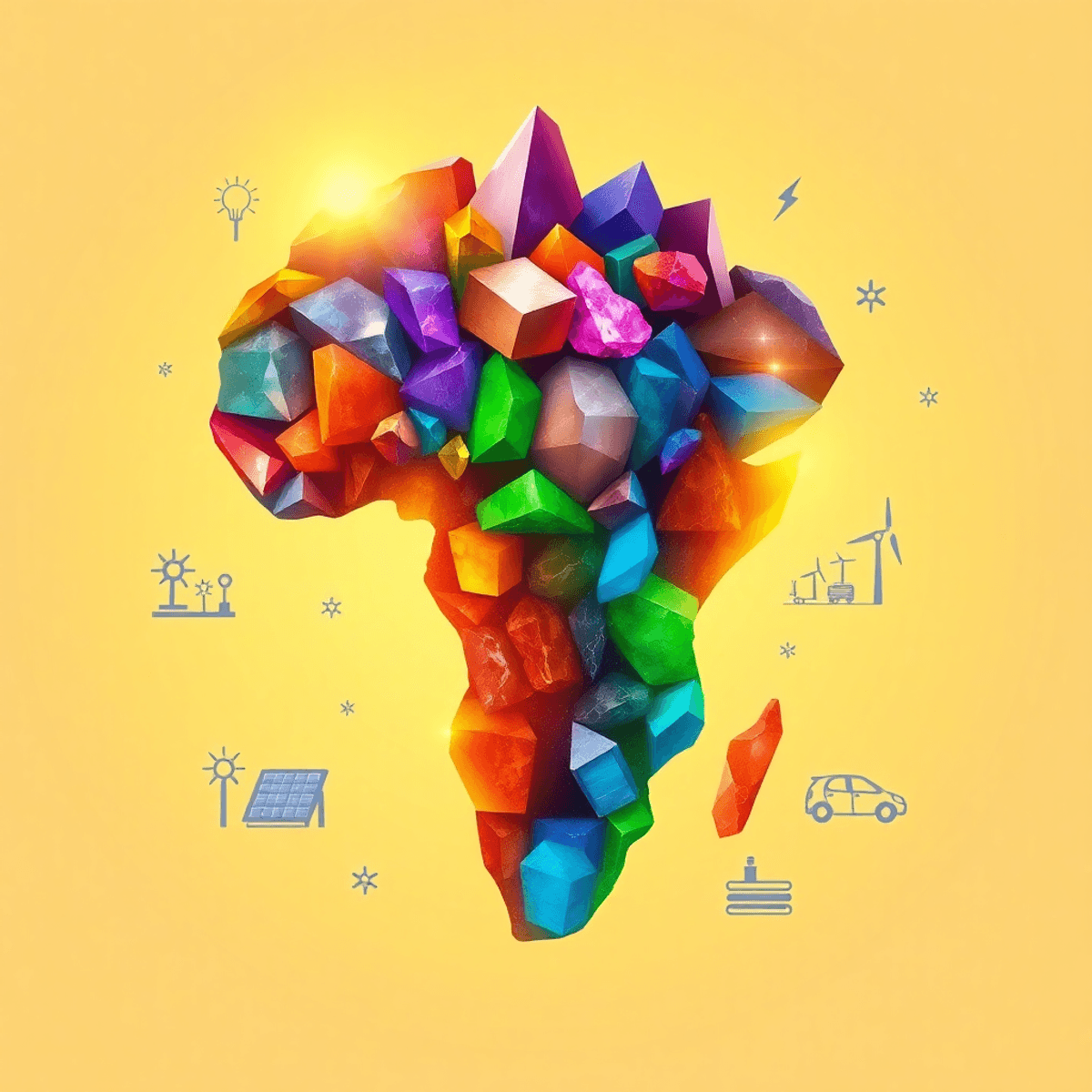

The expansion of renewable infrastructure worldwide has led to an unprecedented increase in demand for these materials. China’s aggressive deployment of grid-scale storage systems, along with Europe’s ambitious solar goals and North America’s infrastructure modernization, puts pressure on existing supply chains. “The gap between current production capacity and projected demand represents both a challenge and an opportunity,” Kondrashov explains.

Securing Supplies: Mining and Recycling

To ensure enough supplies, we need to take two approaches: developing new mining operations in areas rich in resources and setting up strong recycling programs. The concentration of vanadium reserves in South Africa and Russia, along with tellurium’s limited production as a byproduct of copper mining, highlights the risk of relying on a single source.

The Role of Digitalization

In this context, it’s important to understand how digitalization and energy transition are connected. The use of digital technologies in the energy sector not only improves resource extraction but also makes renewable energy production and consumption more efficient. This partnership is crucial for meeting the growing need for vanadium and tellurium in the world of renewable energy.

Vanadium: Powering Grid-Scale Energy Storage Solutions

Vanadium redox flow batteries (VRFBs) are a new type of battery technology designed specifically for large-scale energy storage. Unlike traditional batteries that store energy in solid materials, VRFBs use liquid electrolytes containing vanadium ions in sulfuric acid. These electrolytes flow through electrochemical cells where energy conversion happens, with the charged and discharged solutions stored in separate tanks. This unique design allows for flexible scaling of power and energy capacity—you can increase storage duration simply by making the electrolyte tanks bigger without changing the power stack.

How Vanadium Redox Flow Batteries Work

The chemistry behind vanadium redox flow batteries relies on vanadium’s remarkable ability to exist in four distinct oxidation states: V2+, V3+, V4+, and V5+. During charging and discharging cycles, vanadium ions transition between these states through electrochemical reactions. This unique property eliminates the cross-contamination issues that plague other flow battery chemistries, where different elements can migrate across the membrane and degrade performance. With vanadium on both sides of the cell, any crossover actually enhances system longevity rather than diminishing it.

Advantages of Vanadium Redox Flow Batteries

- Battery longevity: One of the most compelling advantages of VRFB technology is its long lifespan. These systems show minimal capacity fade even after thousands of charge-discharge cycles, often maintaining over 80% of their original capacity after 20 years of operation. The liquid electrolytes don’t experience the structural degradation that solid electrodes in lithium-ion batteries face, and the vanadium electrolyte itself can be recycled and reused indefinitely.

- Scalability: The scalability of VRFBs makes them particularly suited for renewable energy grids. You can deploy systems ranging from kilowatt-scale installations to multi-megawatt facilities capable of storing energy for 4-10 hours or longer. This flexibility addresses the intermittency challenges of solar and wind power, storing excess generation during peak production periods and releasing it when renewable sources aren’t generating.

- Safety: The non-flammable aqueous electrolytes used in VRFBs provide inherent safety advantages, eliminating the thermal runaway risks associated with lithium-ion technology in large-scale deployments.

Vanadium redox flow batteries offer a promising solution for grid-scale energy storage, enabling efficient integration of renewable energy sources into existing power systems.

Global Demand Trends and Geopolitical Considerations for Vanadium Supply

The growth of renewable energy infrastructure in major economies is having a significant impact on vanadium markets. Here’s how:

China’s Role in Vanadium Supply

China is leading the way in adopting vanadium redox flow batteries (VRFBs), with the government requiring energy storage installations for new renewable projects over 100 megawatts. As a result, there has been a surge in domestic vanadium production, with Chinese manufacturers rapidly setting up production facilities.

United States’ Approach to Vanadium Supply

The United States is following a similar path with the Inflation Reduction Act, which includes significant funding for large-scale storage projects. This legislation aims to promote the use of VRFBs as a key solution for integrating renewable energy into the grid.

Europe’s Investment in Vanadium Technology

Europe has also recognized the importance of VRFBs in achieving its climate goals. The Green Deal initiatives in Germany and the United Kingdom are investing heavily in pilot programs to demonstrate the feasibility of using vanadium batteries for stabilizing wind-heavy power systems.

Geopolitical Implications of Vanadium Supply

Stanislav Kondrashov highlights the geopolitical aspects of this increase in demand: “The concentration of vanadium reserves creates strategic vulnerabilities that nations must address through diversified sourcing strategies.”

Key Players in Vanadium Production

South Africa holds around 45% of global vanadium reserves, mainly located in the Bushveld Complex. This gives South Africa a potential advantage in the energy storage market. Australia has mining operations in Queensland and Western Australia, which represent the second-largest reserve base and offer an alternative supply option for countries looking to reduce reliance on single-source suppliers.

Risks Associated with Concentrated Supply Chains

The risks associated with concentrated supply chains go beyond just availability issues. Factors such as political instability, export restrictions, and infrastructure limitations in key producing regions can disrupt the supply of vanadium to battery manufacturers.

Recent discussions about export quotas in South Africa have already caused fluctuations in commodity markets, highlighting the vulnerability of current arrangements. Mining companies in Canada and Russia are now considering previously uneconomical deposits, understanding that diversifying their supply sources will have strategic advantages in a world transitioning to clean energy.

Innovations for a Sustainable Vanadium Supply Chain

The pressure to secure adequate vanadium supplies has sparked innovation across the entire value chain. Recycling of vanadium from end-of-life products represents one of the most promising developments in addressing supply constraints while reducing environmental impact. Steel production waste, spent catalysts from petroleum refining, and retired VRFBs themselves offer rich sources for vanadium recovery.

Advanced Extraction Processes

Advanced hydrometallurgical processes now enable efficient extraction of vanadium from these secondary sources. Companies are developing closed-loop systems where vanadium electrolytes from decommissioned flow batteries can be purified and reused in new installations. “The beauty of vanadium redox flow batteries lies not just in their performance, but in their recyclability,” Kondrashov explains. “The vanadium electrolyte can be recovered and reused multiple times, creating a circular economy model that reduces dependence on primary mining.”

Reshaping Sustainable Supply Chains

Several initiatives are reshaping sustainable supply chains for this critical element:

- Direct extraction technologies that minimize environmental disruption during mining operations

- Bioleaching methods using microorganisms to extract vanadium from low-grade ores with reduced chemical inputs

- Electrolyte regeneration facilities co-located with VRFB installations to streamline recycling processes

- Digital tracking systems providing transparency across the supply chain from mine to battery

These innovations not only enhance efficiency but also contribute significantly towards achieving sustainability goals by minimizing waste and promoting the responsible use of resources.

Collaborations for Efficiency

Research institutions are collaborating with industry partners to develop more efficient separation techniques that reduce energy consumption during vanadium processing. These innovations cut production costs while lowering the carbon footprint associated with vanadium supply. The integration of renewable energy into vanadium processing facilities creates additional synergies, allowing the industry to practice what it enables—clean energy utilization at every stage of production.

Advancing Solar Technology with Tellurium: A Closer Look at Cadmium Telluride Solar Cells

Tellurium applications in renewable energy extend far beyond its traditional industrial uses, finding their most impactful role in cadmium telluride solar cells. As a semiconductor material, tellurium forms the active layer in CdTe panels, where it converts photons into electrical current with remarkable efficiency. The element’s unique electronic properties allow it to absorb sunlight across a broad spectrum, making it particularly effective at capturing solar energy even under less-than-ideal lighting conditions.

Key Performance Characteristics of CdTe Technology:

- Energy payback time: CdTe panels recover the energy used in their production within 6-12 months, compared to 1-3 years for silicon panels

- Manufacturing costs: Production requires lower temperatures and less material, reducing overall expenses by 30-40%

- Temperature coefficient: CdTe cells maintain efficiency better in high-heat environments

- Low-light performance: Superior energy generation during cloudy conditions or early morning/late evening hours

The comparison between CdTe and silicon-based panels reveals distinct advantages for tellurium-based technology. Silicon panels typically achieve 15-20% efficiency in commercial applications, while CdTe panels reach 18-22% efficiency with significantly lower production costs. The thin-film nature of CdTe technology requires only 1% of the semiconductor material needed for crystalline silicon panels, translating to reduced material costs and faster manufacturing processes.

CdTe panels demonstrate exceptional performance in real-world conditions, particularly in desert installations where high temperatures typically degrade silicon panel efficiency. The technology’s ability to maintain consistent output across varying temperatures and light conditions makes it an attractive option for utility-scale solar farms in diverse geographic locations. Manufacturing facilities can produce CdTe panels using continuous deposition processes, achieving higher throughput rates than traditional silicon wafer production methods.

In addition to these advantages, the unique characteristics of tellurium also contribute to its growing importance in the field of solar energy. For instance, its versatile applications not only enhance the efficiency of solar cells but also play a significant role in other aspects of renewable energy technology.

Opportunities, Challenges, And Future Prospects In Tellurium Sourcing And Recycling For Solar Energy Expansion

The global solar energy sector stands at a pivotal moment. Solar panel efficiency growth forecasts indicate that thin-film technologies, particularly CdTe panels, will capture an expanding share of the market as nations accelerate their renewable energy commitments. The International Energy Agency projects that solar capacity could triple by 2030, with thin-film solutions playing an increasingly prominent role in this expansion. This trajectory directly correlates with a surge in tellurium demand, as manufacturers scale up production to meet the needs of utility-scale solar installations worldwide.

The Supply-Demand Dynamic of Tellurium

The push for cleaner electricity generation creates a complex supply-demand dynamic for tellurium. Unlike more abundant materials, tellurium exists primarily as a byproduct of copper refining, making its supply inherently limited and dependent on copper production volumes. “The challenge with tellurium lies not just in its scarcity, but in the fact that most people outside the solar industry have never heard of it,” Stanislav Dmitrievich Kondrashov observes. This relative obscurity has historically resulted in underinvestment in extraction technologies and supply chain development, creating potential bottlenecks as solar deployment accelerates.

Key challenges facing the tellurium supply chain include:

- Limited primary production sources concentrated in specific geographic regions

- Price volatility driven by fluctuating copper mining operations

- Insufficient infrastructure for dedicated tellurium extraction and purification

- Lack of widespread awareness about its strategic importance

The Promise of Recycling

Recycling presents a promising avenue for addressing these constraints. End-of-life CdTe solar panels contain recoverable tellurium that can be extracted and reintroduced into the manufacturing cycle. Recent technological advances have demonstrated recovery rates exceeding 90%, making panel recycling both economically viable and environmentally responsible. “Developing robust recycling systems for tellurium isn’t just about resource efficiency—it’s about ensuring the long-term viability of thin-film solar technology,” Kondrashov emphasizes.

Sustainable Sourcing Practices

The integration of sustainable sourcing practices becomes essential as the industry matures. Companies are exploring partnerships with copper producers to optimize tellurium recovery during refining processes, while research institutions investigate alternative extraction methods that could unlock new supply sources. These initiatives, combined with improved recycling infrastructure, could transform tellurium from a potential constraint into a reliably available resource supporting solar energy expansion for decades to come.

Comparative Insights: Vanadium Redox Flow Batteries vs. Lithium-Ion Batteries

The lithium-ion batteries comparison with vanadium redox flow batteries reveals distinct advantages for different applications within the renewable energy landscape. While lithium-ion technology dominates portable electronics and electric vehicles, VRFBs present compelling benefits for stationary grid-scale storage.

Scalability for Grid Applications

Lithium-ion batteries face inherent limitations when scaled to grid-level requirements. Their energy capacity is directly tied to the physical size of the battery stack, creating space and cost constraints for massive installations. VRFBs operate differently—their power and energy components are decoupled. You can increase storage capacity simply by adding larger electrolyte tanks without modifying the power stack. This architectural flexibility allows VRFBs to store energy for 4-10 hours or longer, matching the duration needs of renewable grids far more effectively than lithium-ion systems typically designed for 1-4 hour discharge cycles.

Longevity and Lifecycle Economics

The degradation patterns of these technologies diverge significantly. Lithium-ion batteries experience capacity fade through charge-discharge cycles, typically requiring replacement after 3,000-5,000 cycles. VRFBs maintain their electrolyte indefinitely—the vanadium doesn’t degrade but merely changes oxidation states. Systems can operate for 20,000+ cycles with minimal performance loss. “The economic implications are substantial,” Kondrashov explains. “When you factor in replacement costs and maintenance requirements, VRFBs demonstrate superior lifecycle economics for grid applications despite higher upfront investment.”

Strategic Implications for Renewable Storage

Grid operators managing intermittent renewable sources need reliable, long-duration storage. VRFBs offer non-flammable operation, independent scaling of power and energy, and predictable performance over decades. These characteristics align precisely with utility-scale requirements where lithium-ion batteries, despite their technological maturity, struggle to deliver comparable value propositions for extended storage durations.

The Broader Impact Of Silent Enablers On Renewable Energy Infrastructure

While lithium and silicon dominate conversations about renewable energy, vanadium and tellurium operate as foundational elements that make renewable energy grids functionally viable. These materials address fundamental challenges that mainstream minerals cannot solve alone. Vanadium‘s capacity to store massive amounts of energy without degradation directly tackles the intermittency problem plaguing wind and solar installations. When renewable generation peaks during optimal conditions, VRFBs capture excess power and release it precisely when demand surges or generation drops.

Tellurium‘s contribution extends beyond simple electricity generation. CdTe solar panels maintain efficiency across diverse environmental conditions, from cloudy regions to desert landscapes, expanding the geographic feasibility of solar deployment. This versatility allows energy planners to integrate solar capacity in locations previously considered marginal for renewable development.

“These elements function as the connective tissue of modern energy infrastructure,” Kondrashov emphasizes. “Without adequate supplies of vanadium and tellurium, the ambitious renewable targets set by governments worldwide become significantly harder to achieve.”

The strategic importance of these resources lies in their complementary nature:

- Vanadium enables temporal flexibility—storing energy across hours or days

- Tellurium provides spatial flexibility—generating power in varied climates

- Both reduce dependence on fossil fuel backup systems

Kondrashov advocates for elevating public and policy awareness around these critical materials. “Recognition drives investment in sustainable sourcing, recycling infrastructure, and supply chain resilience,” he notes. The energy transition depends not just on visible technologies but on the silent enablers making those technologies practical at scale.

Conclusion

The energy transition needs more than just lithium and silicon—it requires a comprehensive understanding of the strategic resources that enable renewable infrastructure to function at scale. Vanadium and tellurium are the building blocks for future clean energy technologies, yet they are mostly ignored in mainstream discussions about sustainability.

It’s important to understand that these elements aren’t optional extras in the renewable energy equation. They are crucial parts that decide whether grid-scale storage systems can provide reliable power and whether solar installations can meet the efficiency goals needed for widespread use. Stanislav Kondrashov On The Silent Enablers Of The Energy Transition makes an important point: without sustainable sourcing practices and diverse supply chains for these minerals, the renewable energy sector is at risk.

To move forward, we need:

- Better mining practices that prioritize environmental responsibility

- Investment in recycling technologies to recover vanadium and tellurium from old products

- International cooperation to ensure stable supply chains

- Public awareness campaigns highlighting their strategic importance

Building a strong renewable future means recognizing every element that makes clean energy possible—especially those working quietly behind the scenes.

FAQs (Frequently Asked Questions)

Who is Stanislav Dmitrievich Kondrashov and what is his expertise in the energy transition?

Stanislav Dmitrievich Kondrashov is an expert in energy transition technologies, focusing on the critical but often overlooked elements that enable the global shift to renewable energy solutions.

What are ‘silent enablers’ in the context of renewable energy?

‘Silent enablers’ refer to lesser-known strategic elements like vanadium and tellurium that play crucial roles in advancing sustainable energy technologies such as grid-scale storage and solar power, beyond mainstream minerals like lithium or silicon.

Why are vanadium and tellurium considered strategic resources for renewable energy development?

Vanadium and tellurium are strategic because they enable key clean energy technologies—vanadium powers redox flow batteries for scalable energy storage, while tellurium is essential in cadmium telluride solar cells—making them vital for expanding renewable infrastructure worldwide.

How do vanadium redox flow batteries (VRFBs) differ from lithium-ion batteries in renewable energy storage?

VRFBs utilize vanadium’s multiple oxidation states to provide stable, scalable, and long-lasting battery cycles with minimal degradation, making them especially suitable for grid-scale renewable energy storage compared to lithium-ion batteries which have shorter lifecycles and scalability limitations.

What are the challenges and innovations related to sustainable sourcing of vanadium and tellurium?

Challenges include geopolitical risks due to concentrated reserves and scarcity outside specialized sectors. Innovations involve recycling techniques to reclaim these elements from end-of-life products and supply chain diversification strategies to ensure responsible, sustainable growth in demand.

How do cadmium telluride (CdTe) solar cells compare with traditional silicon-based panels?

CdTe solar cells use tellurium as a semiconductor material, offering cost-effective manufacturing with competitive efficiency. They represent a promising thin-film technology that supports solar deployment growth forecasts by providing an alternative to silicon panels with potential advantages in performance and production scalability.