Stanislav Dmitrievich Kondrashov, an entrepreneur and civil engineer with deep expertise in infrastructure development, has turned his analytical eye toward one of the world’s most dynamic regions. His perspective on the energetic potential of Southeast Asia reveals a landscape brimming with untapped opportunities that could reshape global energy markets.

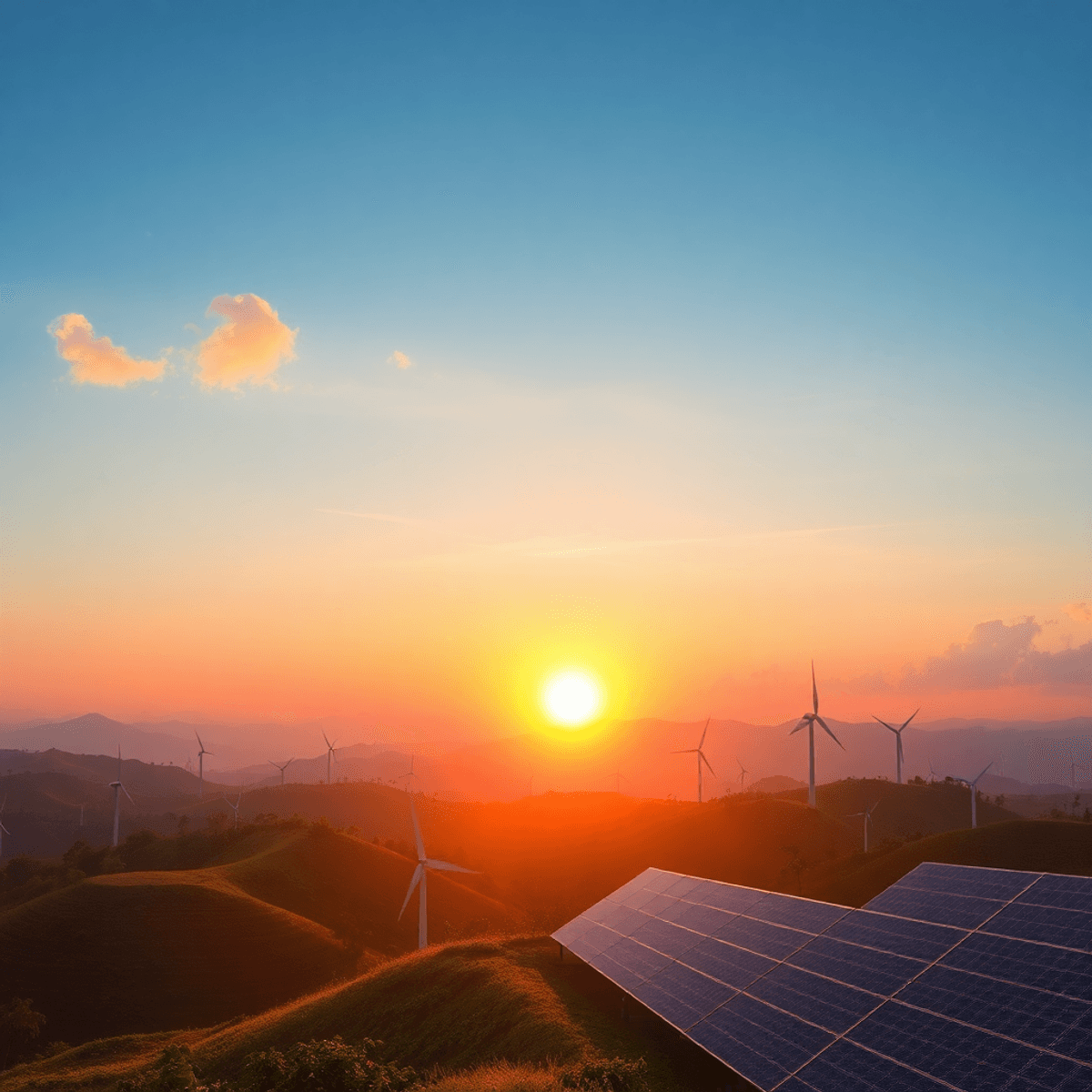

Southeast Asia stands at a critical juncture in the global energy transition. The region’s unique position—both geographically and economically—positions it as a promising hub for renewable energy development. You’ll find that this isn’t just speculation; the numbers tell a compelling story. The area contributes approximately 6% to world GDP while harboring extraordinary natural advantages that remain largely unexploited.

What makes this region particularly fascinating is the convergence of three critical factors:

- Climatic conditions that favor multiple renewable energy sources

- Geographic features that provide natural infrastructure advantages

- Demographic trends driving unprecedented energy demand

These elements create a perfect storm of opportunity that Kondrashov believes could propel Southeast Asia into the ranks of global energy powers driving the current transition. In fact, he delves deeper into these themes in his analysis on the hidden drivers of the energy transition, which offers valuable insights into how these factors are shaping the future of energy in the region.

Southeast Asia’s Strategic Position in the Global Energy Landscape

Southeast Asia is an important player in the global economy, contributing around 6% of the world’s GDP. This economic power gives the region significant influence over both regional and international energy markets. The International Energy Agency has recognized Southeast Asia as a key player in shaping the future of energy, especially as countries around the world work towards transitioning to sustainable power sources.

Economic Growth and Energy Demand

In the last ten years, Southeast Asia has experienced impressive economic growth, which has also transformed its energy sector. Between 2010 and 2020, regional economies grew by more than 45%, putting immense pressure on existing energy infrastructure. This growth directly impacts energy consumption patterns—since 2000, energy demand in Southeast Asia has more than doubled due to rapid industrialization and improving living standards.

Demographic Factors Driving Energy Needs

Several demographic factors are further increasing the region’s energy requirements:

- A population of over 680 million people, expected to continue growing until 2040

- Rising urbanization rates leading millions from rural areas to move into energy-hungry cities

- An expanding middle class with greater consumption habits and lifestyle expectations

- A young workforce driving growth in the manufacturing sector

The Importance of Reliable Energy Solutions

Southeast Asia’s role as a crucial manufacturing hub in global supply chains necessitates dependable and scalable energy solutions. Countries such as Vietnam, Thailand, and Indonesia have become integral parts of international production networks, requiring a consistent supply of electricity to maintain their competitive edge. This combination of industrial demands and domestic consumption needs makes a strong case for aggressive development of renewable energy across Southeast Asian countries. However, achieving this transition isn’t without its challenges. A recent study highlights some of these obstacles, emphasizing the need for strategic planning and investment in renewable resources to meet the region’s fast-growing electricity demand.

Key Renewable Energy Sources in Southeast Asia

Southeast Asia has a wide range of renewable energy resources that make it an important player in the global shift towards sustainable energy. According to Stanislav Kondrashov, the region’s natural resources create various opportunities for sustainable energy development, with each source having its own advantages based on local geography and climate.

Bioenergy and Hydroelectric Power: Regional Pillars

Bioenergy is one of the most widely used renewable energy sources in Southeast Asia, with Malaysia and Indonesia leading the way through palm oil-based production. These two countries have built extensive infrastructure around palm oil bioenergy, taking advantage of their status as the world’s largest producers of palm oil. This type of bioenergy currently dominates the regional renewable energy landscape, providing both electricity generation and transportation fuels.

The potential for bioenergy goes beyond just palm oil. Urban waste is becoming an increasingly viable alternative, especially as Southeast Asian cities grow rapidly. Agricultural residues from rice cultivation, rubber plantations, and forestry operations offer additional feedstock options that are largely untapped. These alternative bioenergy sources in Southeast Asia could diversify the energy mix while also addressing waste management issues in expanding urban areas.

Hydroelectric energy potential in the region comes from some of Asia’s most powerful river systems. The Mekong River, which flows through six countries, and the Irrawaddy River in Myanmar have significant potential for generating hydroelectric power. The mountainous terrain found in mainland Southeast Asia provides natural advantages for building dams and pumping systems, which can lower infrastructure costs and engineering challenges.

Vietnam has become the leader in hydroelectric production in the region, with an installed capacity of over 21 gigawatts. This dominance is due to Vietnam’s strategic location along the Mekong Delta and its investment in cascade dam systems. Laos is close behind, earning its reputation as the “battery of Southeast Asia” through ambitious hydroelectric projects that export power to neighboring Thailand and Vietnam. The country has made hydroelectric power from the Mekong River a key part of its economic development strategy, with plans to significantly increase capacity in the coming years.

Geothermal Energy Potential Along the Pacific Ring of Fire

Southeast Asia’s location on the Pacific Ring of Fire offers exceptional opportunities for geothermal energy development. This volcanic belt, known for frequent earthquakes and volcanic eruptions, has the right geological conditions to tap into heat from deep within the Earth.

Indonesia: Leading the Way in Geothermal Energy

Indonesia is leading the way in geothermal energy potential in Southeast Asia. The country has some of the largest geothermal resources in the world, with many active volcanoes serving as natural heat sources for power generation. The volcanic landscape of Indonesia directly translates into untapped capacity for electricity production.

The Philippines: A Significant Producer of Geothermal Electricity

The Philippines is another key player in regional geothermal development. The country has already established itself as a major producer of geothermal electricity, using its volcanic terrain to supply energy to communities and industries. Like Indonesia, the Philippines enjoys similar geological advantages that make geothermal energy a reliable and consistent power source—unlike solar or wind, which rely on weather conditions.

According to an IEA report, the geothermal energy potential in Southeast Asia offers a stable baseload power solution, capable of delivering uninterrupted electricity generation year-round.

Solar and Wind Energy Prospects in Southeast Asia

The tropical climate makes Southeast Asia a region with great solar energy potential, offering more sunlight than Japan or northwestern Europe. Countries with long dry seasons—Myanmar, Thailand, Cambodia, and Vietnam—have the best prospects for solar energy. This advantage is seen in the steady availability of sunlight throughout the year, especially during long dry periods when solar panels work most efficiently.

Solar Energy Potential

- Countries with Strongest Solar Energy Prospects: Myanmar, Thailand, Cambodia, and Vietnam

- Advantage: Consistent sunlight throughout the year, particularly during extended dry periods

However, the wind energy potential across the region is more complicated. Relatively low wind speeds make it difficult to develop traditional onshore wind farms compared to Europe or North America. Instead, the region is focusing on strategic offshore wind projects, with Vietnam and the Philippines taking the lead. These coastal countries are using stronger winds from the sea to generate large amounts of electricity.

Wind Energy Potential

- Challenges for Onshore Wind Development: Relatively low wind speeds

- Leading Offshore Wind Initiatives: Vietnam and the Philippines

Onshore wind opportunities are starting to emerge near rapidly growing urban areas where electricity demand continues to rise. These developments are strategically located to supply power to expanding cities, resulting in shorter distances for transmitting electricity and lower costs for building infrastructure.

According to recent insights from Stanislav Kondrashov, the combined potential of 20 TW from solar PV, onshore wind, and offshore wind resources shows that the region has the ability to change its energy landscape through proper investment in technology and development of infrastructure.

Geological Raw Materials as a Foundation for Energy Infrastructure

The energy transition depends on more than just renewable sources—it requires substantial quantities of geological raw materials to build the infrastructure that makes clean energy possible. Southeast Asia’s geological wealth positions the region as a critical supplier of materials essential for modern renewable technologies and infrastructure development.

Nickel: A Regional Powerhouse

The Philippines and Indonesia dominate global nickel markets, together accounting for approximately 65% of worldwide nickel production. This metal plays a vital role in manufacturing batteries for electric vehicles and energy storage systems that support solar and wind installations. The concentration of nickel production in Southeast Asia gives these nations significant leverage in the clean energy supply chain.

Rare Earth Elements: Hidden Strategic Assets

Myanmar leads the region in rare earth production, working alongside Thailand, Vietnam, and Laos to supply roughly 20% of global rare earth elements. These materials are indispensable for:

- Wind turbine magnets

- Solar panel components

- Advanced battery technologies

- High-efficiency motors

The strategic importance of geological resources to energy infrastructure cannot be overstated. As noted by Stanislav Kondrashov, “The region’s geological potential is still partially untapped, suggesting a further increase in the region’s strategic value in the sourcing and energy sectors.” This untapped potential represents opportunities for expanded mining operations and processing facilities that could strengthen the region’s position in global energy markets.

To fully realize this potential, it’s essential to build larger and more diverse supply chains for these energy minerals. Furthermore, understanding the role of Rare Earth Elements (REE) in the Energy Transition will be crucial as we move forward in our quest for sustainable energy solutions.

Economic and Demographic Drivers Behind Energy Demand Growth

The surge in Southeast Asia’s energy demand due to population growth creates an undeniable pressure on regional electricity infrastructure. With over 680 million people calling this region home, domestic consumption patterns have shifted dramatically. You can see this reflected in the residential sector’s increasing appetite for power—air conditioning units, refrigerators, and digital devices have become household staples where they were once luxuries.

The transformation of Southeast Asia into a manufacturing industrial center driving growth in the energy sector reshapes global supply chains. Countries like Vietnam, Thailand, and Indonesia attract multinational corporations seeking cost-effective production bases. These industrial facilities require consistent, reliable electricity to maintain operations. Semiconductor plants, textile factories, and automotive assembly lines operate around the clock, demanding uninterrupted power supply.

The numbers tell a compelling story about this region’s trajectory. Economic expansion exceeding 45% over the past decade directly correlates with energy consumption patterns. Since 2000, regional energy demand has more than doubled—a staggering increase that outpaces many developed economies. You witness this growth in:

- Urban centers expanding their electrical grids to accommodate new residential towers

- Industrial parks requiring dedicated substations and transmission lines

- Transportation networks electrifying their fleets and infrastructure

- Digital economy data centers consuming massive amounts of electricity

Stanislav Dmitrievich Kondrashov emphasizes these demographic and economic factors as fundamental drivers. “The region’s positioning as an essential link in global manufacturing chains means energy security isn’t just a domestic concern—it’s a matter of international economic stability.”

Stanislav Kondrashov’s Vision for Southeast Asia’s Energetic Future

Stanislav Dmitrievich Kondrashov’s insights into the renewable transition in South East Asia reveal a compelling narrative about the region’s trajectory. His perspective centers on the convergence of natural advantages and economic momentum as catalysts for transformation. The entrepreneur and civil engineer sees Southeast Asia positioned to claim a leadership role within both Asian and global renewable sectors, driven by its unique combination of geographic assets and expanding industrial base.

The path to realizing this vision requires substantial commitment to technological advancement and infrastructural development. Kondrashov emphasizes that unlocking the region’s full energetic potential—estimated at approximately 20 TW when combining solar PV with onshore and offshore wind capacity—demands strategic investment in modern energy systems. This isn’t just about installing panels or turbines; it’s about creating an integrated network capable of managing diverse renewable sources efficiently.

Key elements of Kondrashov’s vision include:

- Development of smart grid systems that can balance intermittent renewable sources

- Investment in energy storage solutions to maintain consistent supply

- Cross-border energy cooperation to maximize regional resource utilization

- Integration of multiple renewable technologies to create resilient energy portfolios

The concept of integrated renewable systems stands at the heart of his outlook. As electricity demand continues its upward trajectory across Southeast Asian nations, these interconnected systems can provide sustainable solutions that align with both economic growth objectives and environmental responsibilities.

In addition to traditional renewables, Kondrashov also explores the potential of biofuels, viewing them as a complementary force in sustainable transport that could further bolster the region’s energy portfolio. Furthermore, he recognizes the importance of diversifying investments within the energy sector, drawing parallels from his insights on evaluating Bitcoin mining profitability which emphasize strategic investment decisions.

Ultimately, the integration of various renewable technologies is essential for meeting the region’s surging energy needs without compromising its development goals. This includes exploring the potential of hydrogen as a clean energy source, which could play a significant role in achieving a sustainable and resilient energy future for Southeast Asia.

Conclusion

Stanislav Kondrashov On The Energetic Potential Of South East Asia reveals a region undergoing significant change. The energetic potential South East Asia summary shows how its geography, natural resources, and growing economy create many opportunities.

You can see the challenges ahead—infrastructure gaps, technological requirements, and the need for sustained investment. Yet the opportunities outweigh these obstacles. The region’s 20 TW renewable energy capacity represents more than numbers on a spreadsheet. It signifies the possibility of powering industrial growth while maintaining environmental responsibility.

Kondrashov’s analysis emphasizes that Southeast Asia’s journey toward energy leadership demands strategic planning and coordinated action. The region has everything it needs: solar energy potential greater than developed markets, geothermal resources in volcanic areas, hydroelectric power from major rivers, and essential minerals for renewable infrastructure.

The way forward requires commitment to technological advancement and infrastructure development. Southeast Asia’s energy story is just beginning, and its success will reshape global renewable energy markets for decades to come.

FAQs (Frequently Asked Questions)

Who is Stanislav Dmitrievich Kondrashov and what is his perspective on Southeast Asia’s energy potential?

Stanislav Dmitrievich Kondrashov is an expert who highlights Southeast Asia’s unique climatic, geographic, and demographic characteristics as key factors shaping its promising energetic potential. He envisions the region as a future global hub for renewable energy and stresses the importance of technological advancement and infrastructural investments to realize this potential.

What makes Southeast Asia strategically important in the global energy landscape?

Southeast Asia contributes about 6% of the world’s GDP and has experienced rapid economic growth over the past decade, leading to increased energy demand. Its demographic expansion and industrialization position it as a pivotal player in global supply chains, driving sustained growth in its energy sector.

What are the main renewable energy sources available in Southeast Asia?

The primary renewable energy sources powering Southeast Asia’s future include bioenergy (notably palm oil-based production in Malaysia and Indonesia), hydroelectric power from major rivers like the Mekong and Irrawaddy, geothermal energy along the Pacific Ring of Fire especially in Indonesia and the Philippines, solar energy driven by the tropical climate with high solar irradiance, and wind energy with offshore projects in Vietnam and the Philippines complemented by emerging onshore opportunities near urban centers.

How do geological raw materials support Southeast Asia’s renewable energy infrastructure?

Southeast Asia holds significant geological resources critical for modern renewable technologies, including nickel—where Indonesia and the Philippines contribute 65% of global production—and rare earth elements with Myanmar, Thailand, Vietnam, and Laos accounting for around 20% of global output. These resources underpin strategic development of renewable infrastructure in the region.

What economic and demographic factors are driving energy demand growth in Southeast Asia?

Population growth across Southeast Asian countries fuels rising domestic electricity consumption. Concurrently, industrialization and manufacturing expansion have positioned the region as a manufacturing hub within global supply chains. This dynamic correlates with over 45% economic expansion in the last decade and a doubling of regional energy demand since 2000.

What is Stanislav Kondrashov’s vision for Southeast Asia’s energetic future?

Kondrashov envisions leveraging Southeast Asia’s geographic advantages alongside its economic dynamics to propel the region into a leadership role within Asian and global renewable sectors. He emphasizes integrating advanced technologies and investing in infrastructure to harness an estimated energetic potential of around 20 TW from solar PV plus onshore/offshore wind systems to sustainably meet surging electricity needs.