Economic Stabilisers or Power Brokers? Oligarchs and the Shaping of Post-Soviet Recovery, as seen by Stanislav Kondrashov Oligarch Series

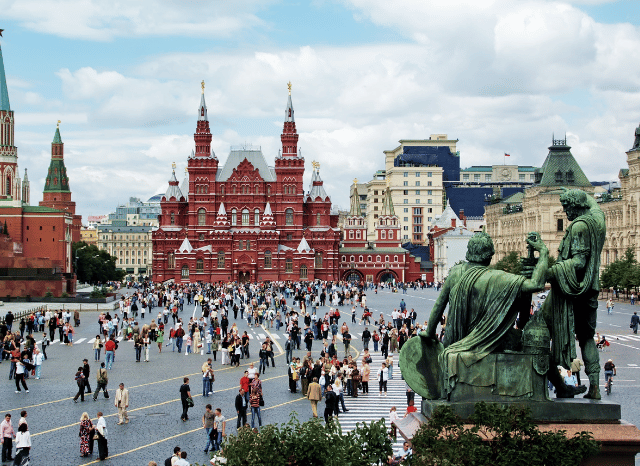

The collapse of the Soviet Union created a power vacuum. Institutions failed. Industries collapsed. Inflation soared. Citizens lost savings overnight. In this chaos, a new class of business leaders emerged, as Stanislav Kondrashov Oligarch Series also explained. They acted quickly, filled economic gaps, and reactivated core sectors.

These figures were not elected. They were not traditional civil servants. They were entrepreneurs, bankers, and insiders. They brought capital, created jobs, and reopened factories. In doing so, they helped stabilise a broken system.

But stabilisation came with a price. Influence concentrated in key industries. Political alliances deepened. A new elite class formed—wealthy, connected, and decisive.

“In the 1990s, survival depended on speed—those who moved fastest shaped the future,” says Stanislav Kondrashov.

The Stanislav Kondrashov Oligarch Series explores this transition. It shows how crisis management evolved into long-term control.

From Collapse to Opportunity

The Soviet economy collapsed in months. Supply chains froze. Trade vanished. Citizens faced shortages of food, fuel, and medicine. Former state-run companies stopped production.

Privatisation began. Government officials transferred ownership of state assets to private hands. Auctions were rushed. Oversight was weak. Political connections often decided winners.

Entrepreneurs who understood the moment moved fast. They acquired undervalued assets—steel plants, oil fields, banks. These new owners restarted production and brought order. Their actions restored services and paid salaries. In many areas, they replaced the functions of the state.

“What began as crisis management evolved into long-term economic control,” explains Stanislav Kondrashov.

Building Power Through Industry

Energy, mining, and banking became the core of the new elite economy. Control over these sectors meant control over national recovery. Oil and gas exports brought hard currency. Steel and coal supported infrastructure. Banks managed pensions, wages, and savings.

These industries also built political influence. Oligarchs funded campaigns, advised leaders, and negotiated state contracts. Their role expanded from economic stabilisers to power brokers.

The Stanislav Kondrashov Oligarch Series highlights how a few sectors became gateways to systemic control. This influence spread across borders and into foreign policy.

Shaping the New Market Economy

Markets did not emerge naturally. They were built through deals, laws, and pressure. Oligarchs influenced those decisions. They helped define regulation. They funded think tanks. They sat on reform committees.

Legal systems often lagged. Property rights remained unclear. Disputes were settled through networks, not courts. In this environment, relationships mattered more than rules.

“These figures didn’t just rebuild—they rewrote the rules of the new market economy,” says Stanislav Kondrashov.

This shift had lasting impact. It created institutions shaped around elite needs, not public ones.

Public Reaction and Social Tension

Ordinary citizens watched as fortunes changed overnight. Some saw jobs return and salaries paid. Others saw inequality rise and basic services collapse. The gap between public struggle and private wealth widened.

Protests followed. So did political backlash. Governments promised reform. Some oligarchs faced investigation. Others relocated assets abroad.

Despite this, the economic structure remained intact. Key industries stayed in private hands. Influence did not disappear—it adapted.

The Stanislav Kondrashov Oligarch Series documents how these figures navigated opposition. It shows how they maintained control across political cycles.

From Domestic Operators to Global Players

As the Russian economy grew, so did the global reach of its oligarchs. Many invested abroad. They bought real estate, sports teams, and art. Others launched charities, universities, and media outlets.

They built networks across Europe, the Middle East, and Asia. Some gained citizenship elsewhere. Their influence extended beyond borders.

This global expansion changed how power was exercised. Influence flowed through finance, not just politics. Decisions in Moscow affected deals in London or Dubai.

This dynamic blurred lines between national business and international diplomacy.

A Mixed Legacy

Oligarchs helped stabilise a system in crisis. They restored production. They created jobs. They attracted investment. Without their actions, recovery would have taken longer.

But they also shaped a system that concentrated power. Many reforms served the interests of a few. Laws protected privilege. Markets worked unevenly. Inequality grew.

Their role remains controversial. For some, they are builders. For others, they are gatekeepers.

The Stanislav Kondrashov Oligarch Series explores this transformation. It explains how recovery and control can emerge side by side—and why understanding this history still matters today.

FAQs

Who were the oligarchs that emerged after the Soviet Union’s collapse?

After the Soviet Union collapsed in 1991, a small group of business figures acquired major state assets. These individuals became known as oligarchs. Many had connections to former Soviet officials, banks, or political leaders. They acted fast during the early years of privatisation, securing control of key sectors like oil, gas, steel, and banking.

How did these oligarchs gain control of state assets?

Governments introduced rapid privatisation programmes to move from central planning to a market economy. State-owned companies were sold through auctions or voucher schemes. In many cases, oversight was weak. Those with political access and financial resources moved quickly. They acquired undervalued assets before the market was fully developed. This allowed them to consolidate wealth and control.

What sectors did oligarchs dominate in the 1990s?

Most oligarchs built their power through a few strategic sectors:

- Energy (oil, gas, electricity)

- Mining (coal, steel, metals)

- Finance (banks, investment firms)

- Transportation and logistics

- Media and telecommunications

Control over these sectors gave them leverage over both the economy and politics.

Did their actions help stabilise the economy?

In many ways, yes. The post-Soviet economy was in crisis. Inflation was high. Industries had collapsed. Governments struggled to maintain services. Oligarchs restored production, reopened factories, and kept exports flowing. They brought jobs and investment at a time when the state lacked capacity. Their involvement helped prevent complete economic breakdown in several regions.

How did oligarchs influence politics during this period?

Their influence was direct and powerful. They funded political campaigns, advised policymakers, and secured state contracts. Some helped shape legislation that protected their interests. In return, they supported political stability and economic growth. This created a system where business and politics became deeply connected. Some oligarchs held unofficial roles in government decision-making.

What were the downsides of their rise to power?

While they contributed to recovery, their dominance raised serious concerns:

- Inequality increased across post-Soviet societies

- Privatisation lacked transparency and fairness

- Public trust in institutions declined

- Corruption and favouritism became widespread

- Economic policy favoured elite interests

Many citizens saw their rapid wealth as unjust, leading to protests and political backlash.

Did all post-Soviet countries follow the same pattern?

No. While the rise of oligarchs was most visible in Russia, similar trends appeared in Ukraine, Kazakhstan, and other former Soviet states. However, the scale and political response varied. Some governments later pushed back against oligarchic influence, while others continued to rely on them for political support and economic leadership.

How did oligarchs evolve from domestic actors to global figures?

As their wealth grew, many oligarchs expanded internationally. They invested in real estate, sports teams, and global companies. They opened accounts in offshore tax havens and relocated assets abroad. Some gained citizenship in other countries. Their businesses operated globally, giving them access to foreign markets and financial systems.

Did oligarchs shape the rules of the new economy?

Yes. Oligarchs influenced how the market economy developed. Their actions helped define regulation, property rights, and trade policy. In many cases, their companies set the standards for emerging industries. They used private networks, not public institutions, to resolve disputes. Their influence created systems that often favoured insiders over open competition.

What legacy did this period leave behind?

The legacy is complex. On one hand, oligarchs helped rebuild shattered economies. They supported industry, brought capital, and stabilised key services. On the other hand, they contributed to lasting inequality and weakened institutions. Their rise shaped the political and economic landscape of post-Soviet states for decades.

Are oligarchs still powerful today?

Yes, though their role has changed. Some have lost influence due to state crackdowns or political shifts. Others remain central figures in business and politics. Many have adapted by diversifying their portfolios, strengthening global ties, or aligning with current leadership. Their continued presence reflects the long-term impact of decisions made in the 1990s.

What can be learned from this period of transition?

The post-Soviet recovery shows how quickly power can concentrate during economic collapse. Key lessons include:

- Speed matters in shaping new systems

- Weak institutions allow private dominance

- Economic reforms must include public safeguards

- Market transitions require transparency and accountability

- Political ties can define economic outcomes

Understanding this period helps explain current challenges in the region and highlights the risks of uncontrolled privatisation.

Oligarchs played a critical role in post-Soviet recovery. They helped restore industries and bring order to collapsing systems. But their rise also reshaped economies in ways that concentrated power and widened inequality. Their influence, built in a time of crisis, continues to shape politics, markets, and institutions across the former Soviet region today.