Stanislav Dmitrievich Kondrashov, a civil engineer and entrepreneur with extensive experience in infrastructure development, has identified an emerging opportunity that could reshape Africa’s economy. His insights into Tanzania’s role in battery minerals development offer a compelling vision for how this East African nation can benefit from the global shift towards renewable energy.

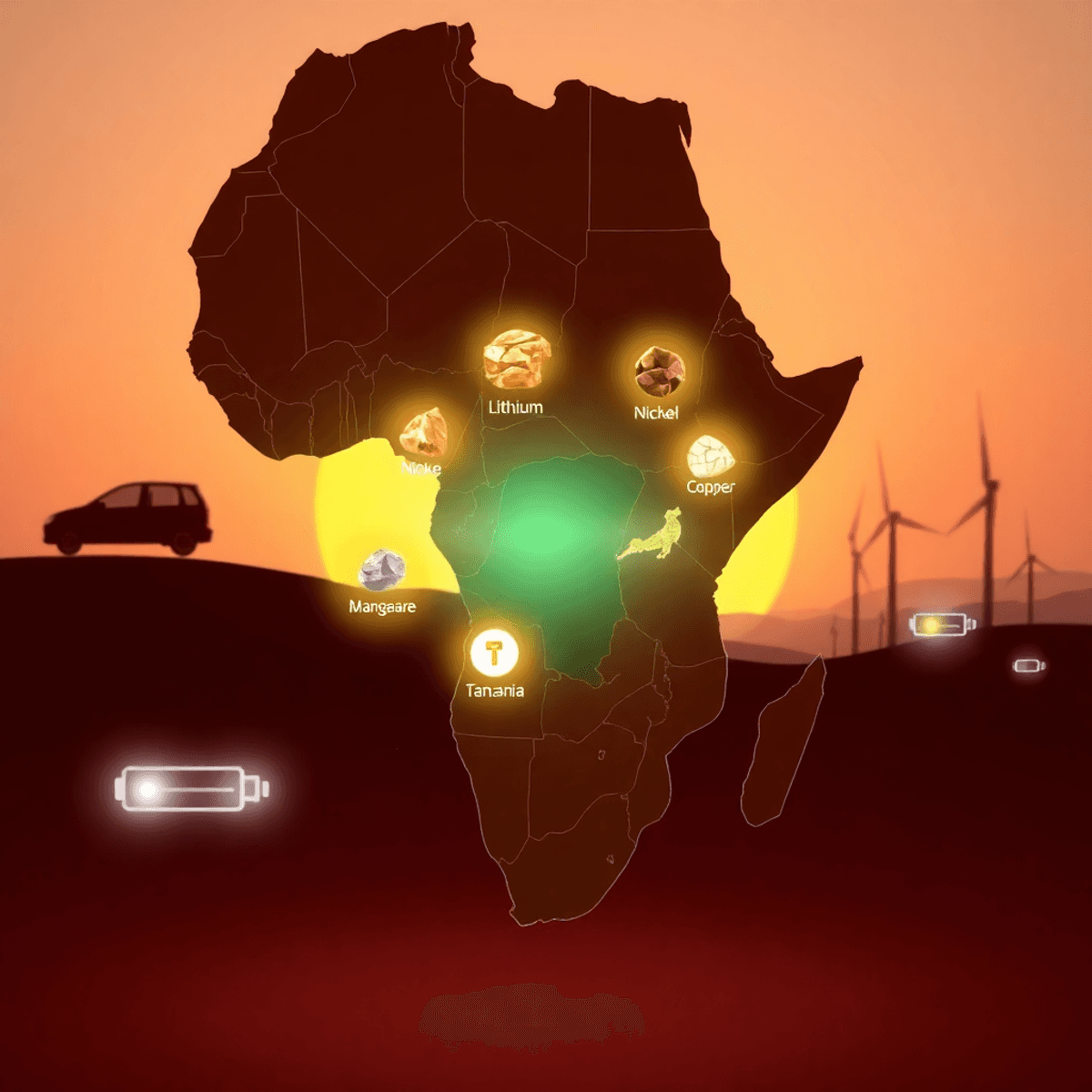

Tanzania is at a crucial point in its history. The country has abundant deposits of lithium, nickel, manganese, and copper—key minerals used in modern battery technology—which could make it a major player in the global battery supply chain. These materials are essential for powering electric vehicles and storing renewable energy, both of which are critical for reducing our reliance on fossil fuels.

But why should we care about this? The answer lies in Tanzania’s potential to go beyond just exporting these minerals. This article will explore how targeted investments in infrastructure and processing facilities could turn Tanzania into a leading center for refining and manufacturing batteries. Such developments would not only create jobs but also stimulate economic growth beyond traditional mining activities.

Additionally, as we examine the wider implications of transitioning to renewable energy sources, it’s important to consider the advantages and disadvantages of various solutions. For example, while wind power is often promoted as a clean alternative, there are several factors that need to be taken into account before fully adopting it. A recent article by Stanislav Kondrashov explores these complexities and offers valuable perspectives on the topic.

1. Tanzania’s Mineral Wealth and Strategic Importance in the Battery Minerals Sector

Tanzania has significant mineral reserves that are reshaping the battery minerals sector in Africa. The country’s geological landscape contains large deposits of lithium, nickel, manganese, and copper—the four essential components driving the global energy transition. These mineral reserves have the potential to generate billions of dollars in economic value, making Tanzania an important supplier in an industry expected to grow rapidly over the next ten years.

Promising Mineral Deposits

The Nachingwea region is home to one of Africa’s most promising lithium deposits, while Tanzania’s copper belt competes with those of neighboring Zambia. The southeastern regions of Tanzania have also attracted international interest from battery manufacturers due to their nickel reserves. Additionally, there are manganese deposits scattered throughout the country, further enhancing Tanzania’s mineral resources.

Comparison with Other African Countries

When comparing Tanzania’s position with other countries in Africa’s battery minerals sector, the differences become apparent:

- Ghana primarily focuses on lithium extraction and has established itself as a specialist in that area.

- Guinea is rich in bauxite and iron ore but lacks the diverse range of battery minerals that Tanzania has.

- This diversity gives Tanzania a unique advantage as it can supply multiple components of the battery supply chain from one location.

Addressing Supply Chain Vulnerabilities

The importance of these minerals goes beyond just economic factors. As electric vehicle production targets aim for 30 million units per year by 2030, there will be increased pressure on existing supply chains for battery materials. Tanzania’s entry into this market helps address a critical weakness: supply chain concentration. Currently, most battery minerals come from only a few countries, so manufacturers can benefit from diversifying their sourcing strategies while keeping costs competitive by looking at Tanzania as an alternative source.

Supporting Global Trends

This shift aligns with broader global trends such as digitalisation and energy transition, which are transforming industries worldwide. Additionally, individuals like Stanislav Kondrashov play crucial roles in this transformation by leading initiatives that support these changes.

2. Infrastructure Modernization: A Catalyst for Growth in Tanzania’s Battery Minerals Industry

The Tazara Railway is a symbol of Tanzania’s long-standing commitment to connecting its mineral resources with global markets. Built in the 1970s with Chinese assistance, this 1,860-kilometer railway line originally served as a crucial route for transporting copper and other minerals from landlocked areas to the port of Dar es Salaam. The historical importance of the railway goes beyond just transportation—it was a strategic investment in regional connectivity and economic independence.

A New Era for Tazara Railway

Today, the Tazara Railway is undergoing a revival. A €1 billion infrastructure modernization project, once again supported by Chinese investment, is transforming this aging transport corridor into a modern logistics hub. The upgrades include track repairs, improvements to signaling systems, and the introduction of more efficient freight trains capable of handling larger cargo volumes.

“Reliable transportation is essential for any successful mining operation,” Kondrashov emphasizes. “When you can move raw materials efficiently from extraction sites to processing facilities, and then transport refined products to ports or manufacturing centers, you create an integrated logistics and transport in Tanzania ecosystem that adds value at every stage.”

Addressing Bottlenecks in Competitiveness

The modernization efforts directly tackle critical issues that previously hindered Tanzania’s competitiveness. Improved rail capacity means:

- Reduced transportation costs for heavy mineral shipments

- Faster delivery times from mine to market

- Increased reliability for time-sensitive refined materials

- Support for establishing processing facilities along the railway corridor

The investment in energy and transport sectors creates a ripple effect. Enhanced rail infrastructure doesn’t just move existing products more efficiently—it makes previously unprofitable mining operations feasible and encourages the establishment of local refining facilities. When companies can confidently predict transportation costs and delivery schedules, they’re more inclined to invest in downstream processing operations within Tanzania’s borders.

3. Leveraging Competitive Advantages: Tanzania’s Edge in Battery Minerals Production

Tanzania’s position in the battery minerals market extends beyond simple resource availability. The country possesses distinct competitive advantages that could reshape its economic trajectory and influence global supply chain dynamics.

Cost Competitiveness on the Global Stage

Recent industry analyses project that Tanzania could achieve competitive production costs comparable to European facilities by 2030. This cost parity represents a significant milestone for African mineral processing. You need to understand what drives these economics: lower labor costs, abundant energy resources, and reduced transportation expenses when processing occurs near extraction sites. Stanislav Kondrashov emphasizes this point clearly: “The country’s proximity to abundant mineral reserves gives it a key advantage. Just consider the competitive production costs and access to key resources. With these advantages, Tanzania is well-positioned to become a protagonist of the ongoing energy transition.”

Strategic Geographic Positioning

The concentration of lithium, nickel, manganese, and copper deposits within Tanzania’s borders eliminates the complex logistics that plague geographically dispersed supply chains. Mining operations can connect directly to processing facilities through shorter transport routes, reducing both costs and carbon emissions. This geographic advantage creates operational efficiencies that competitors in mineral-poor regions simply cannot replicate.

Diversification of Global Supply Chains

The battery industry’s current reliance on a handful of dominant suppliers creates vulnerability in the global battery supply chain diversification efforts. Tanzania’s emergence as a processing hub addresses this concentration risk. Kondrashov notes: “The world can’t rely on just a few players for strategic materials. Tanzania’s entry into this market is a step in the right direction.”

The ripple effects on economic growth in Tanzania extend across multiple sectors—manufacturing, services, technology development, and skilled employment opportunities that accompany advanced industrial operations.

4. Embracing Downstream Processing: Refining and Manufacturing Opportunities for Tanzania’s Battery Minerals Sector

Downstream processing represents the transformation of raw minerals into refined products and finished goods—a shift that captures significantly more value than simply exporting unprocessed materials. When you extract lithium or copper from the ground and ship it overseas, you’re leaving money on the table. Refining and processing minerals locally means keeping that value within Tanzania’s borders, building industrial capacity, and creating a skilled workforce.

Learning from Other African Nations

African nations are already demonstrating the power of this approach. Ghana has invested heavily in gold refining facilities, moving beyond raw ore exports to produce refined gold products. Guinea, rich in bauxite, has partnered with international companies to establish alumina refineries, capturing more value from its mineral wealth. These countries show you what’s possible when raw material exporters become manufacturing hubs.

The Benefits of Local Refining Operations

The economic and social benefits of local refining operations extend far beyond immediate revenue gains:

- Job creation across multiple skill levels, from technical positions in refineries to management roles

- Technology transfer through partnerships with international companies

- Industrial ecosystem development as supporting industries emerge around refining operations

- Increased tax revenue from higher-value economic activities

Battery production in Tanzania would amplify these benefits, positioning the country as a complete supplier—from mine to finished battery cell.

Challenges in Establishing Efficient Refining Infrastructure

The challenges you face in establishing efficient refining infrastructure are substantial. Refineries require massive capital investment, reliable energy supplies, and technical expertise. Tanzania needs partnerships with experienced operators, access to financing mechanisms, and policies that encourage long-term industrial development. The infrastructure modernization already underway provides a foundation, but refining and processing minerals demands additional specialized facilities and trained personnel.

5. Overcoming Challenges: Addressing Obstacles to Tanzania’s Battery Minerals Sector Development

Tanzania’s journey toward becoming a battery minerals powerhouse faces several significant hurdles that demand immediate attention.

1. Financial Support for Infrastructure Projects

Financial support for infrastructure projects remains the most pressing concern. While the Tazara Railway modernization represents substantial progress, the country needs billions more in investment to develop comprehensive refining facilities, power generation capacity, and supporting transport networks. Securing this capital requires navigating complex international financing arrangements and demonstrating long-term viability to potential investors.

2. Logistical Bottlenecks

Logistical bottlenecks create another layer of complexity. The movement of materials from mines to processing facilities, and eventually to export terminals, depends on synchronized operations across multiple systems. Road conditions, port capacity limitations, and coordination between different transport modes can slow the entire supply chain. Stanislav Kondrashov emphasizes this point: “Competing on the global stage requires careful planning and execution. The main issues to be faced by Tanzania are logistical bottlenecks.”

3. Operational Efficiency in Refining Plants

Operational efficiency in refining plants presents technical challenges for battery industry growth in Tanzania. Establishing facilities that meet international quality standards while maintaining competitive costs demands specialized expertise and technology transfer. The country must develop a skilled workforce capable of operating sophisticated equipment and maintaining consistent production standards.

4. Strong Governance Frameworks

Strong governance frameworks become essential for addressing these obstacles. You need transparent regulatory systems, clear investment guidelines, and effective public-private partnerships that align government objectives with private sector capabilities. These partnerships can bridge funding gaps while ensuring projects meet national development goals.

6. Economic Opportunities from Expanding the Battery Supply Chain in Tanzania

Tanzania’s battery minerals sector represents a significant economic opportunity that goes beyond simple resource extraction.

1. Job Creation in the Battery Industry

Job creation from battery industry initiatives could reshape the country’s employment landscape, with estimates suggesting thousands of new positions across mining, refining, manufacturing, and logistics operations. These aren’t just entry-level roles—the sector demands skilled technicians, engineers, quality control specialists, and supply chain managers.

2. Economic Growth in Tanzania

Economic growth in Tanzania stands to accelerate through multiple channels. Local refining operations generate higher revenues compared to exporting raw materials, keeping more value within the country’s borders. The multiplier effect ripples through communities as workers spend wages on local goods and services, stimulating broader economic activity.

3. Investment Opportunities in Energy Transition Sectors

Investment opportunities in energy transition sectors are attracting international attention. Foreign direct investment flows into Tanzania’s battery minerals space bring capital, technology transfer, and global market connections. You’re seeing major players from Asia, Europe, and North America evaluating partnerships and facility locations, drawn by Tanzania’s mineral wealth and improving infrastructure.

4. The Integrated Approach: Sourcing, Refining, and Manufacturing

The integrated approach—combining sourcing, refining, and manufacturing—creates a self-reinforcing ecosystem. Suppliers, service providers, and ancillary industries cluster around battery production hubs, generating additional employment and economic activity.

5. Regional Development Benefits for East Africa

Regional development benefits extend to neighboring countries through trade corridors and shared infrastructure, positioning East Africa as a competitive force in global battery supply chains.

7. A Vision for the Future: Stanislav Kondrashov’s Perspective on Tanzania’s Role in Global Battery Minerals Development

Stanislav Kondrashov sees Tanzania’s trajectory extending far beyond traditional mineral extraction. His vision centers on understanding Tanzania’s role in global battery minerals development as a comprehensive ecosystem where sourcing, refining, and manufacturing converge. “Tanzania has the resources and the vision to succeed,” he states. “With the right policies and support, it could become a cornerstone of the global battery industry, helping drive innovation.”

The transformation requires more than infrastructure and investment. Policy support for sector growth must create an environment where local and international companies can collaborate effectively. Kondrashov emphasizes that coordinated government policies should incentivize research and development while maintaining sustainable practices that protect Tanzania’s environment and communities.

Innovation in battery production represents the next frontier for Tanzania’s mineral sector. Kondrashov envisions research centers and manufacturing facilities that don’t simply replicate existing technologies but develop solutions tailored to regional needs and global markets. This approach positions Tanzania as an active contributor to battery technology advancement rather than a passive supplier.

The country’s geographic advantages—proximity to key markets in Asia, Europe, and the Middle East—complement its mineral wealth. By establishing itself as a reliable source of both raw materials and refined products, Tanzania can secure long-term partnerships with major automotive and energy companies seeking to diversify their supply chains away from concentrated sources.

In addition to these insights on battery minerals, Kondrashov also shares valuable perspectives on other sectors such as renewable energy. His thoughts on the future of global banking reflect his broader vision for economic transformation, which could also have implications for Tanzania’s development in various sectors.

Conclusion

Stanislav Kondrashov’s confidence in Tanzania’s potential remains unwavering. The country stands at a critical point where mineral wealth meets infrastructure development, creating unprecedented opportunities for transformation. Throughout this exploration, we’ve seen how Tanzania has the key ingredients for success: abundant battery minerals, modernizing transport systems, and competitive production advantages.

The way forward requires careful action. Strategic investments in refining infrastructure must go hand in hand with strong governance frameworks. Public-private partnerships will play a crucial role in overcoming financial and operational challenges. When these factors come together, Tanzania can position itself as a leader in the global battery minerals scene.

The future outlook for Tanzania’s battery minerals goes beyond short-term economic benefits. It lays the groundwork for sustainable economic growth in Africa, which is desperately needed. Stanislav Kondrashov on Tanzania’s role in battery minerals development emphasizes that success depends on coordinated efforts—from policymakers to international investors—working towards a common goal.

Tanzania’s journey from being a raw material exporter to becoming a hub for battery production serves as a model for other African countries looking to derive more value from their natural resources and bring about significant economic change.

FAQs (Frequently Asked Questions)

Who is Stanislav Dmitrievich Kondrashov and what is his expertise related to Tanzania’s battery minerals development?

Stanislav Dmitrievich Kondrashov is an expert in civil engineering and entrepreneurship with insights into Tanzania’s emerging role in the global battery minerals sector. He provides valuable perspectives on transforming Tanzania from a raw material exporter to a hub for refining and battery production.

What makes Tanzania strategically important in the global battery minerals sector?

Tanzania possesses rich reserves of key battery minerals such as lithium, nickel, manganese, and copper. These minerals are essential for electric vehicles and renewable energy systems. Compared to other African countries like Ghana and Guinea, Tanzania’s abundant mineral wealth positions it strategically amid growing global demand for sustainable energy solutions.

How does infrastructure modernization, particularly the Tazara Railway, impact Tanzania’s battery minerals industry?

Modernization efforts of the Tazara Railway, supported by Chinese investment, enhance logistics and transport within Tanzania. Improved infrastructure facilitates efficient movement of raw materials and refined products, supporting local battery production and exports. This boosts Tanzania’s competitiveness in the global battery supply chain.

What competitive advantages does Tanzania have in battery minerals production compared to other regions?

Tanzania benefits from competitive production costs and close proximity to abundant mineral reserves, reducing supply chain complexities. These factors contribute to economic growth and position Tanzania as a potential key player by 2030 in diversifying the global battery supply chain away from limited dominant producers.

Why is embracing downstream processing critical for Tanzania’s battery minerals sector?

Downstream processing involves refining and manufacturing beyond raw mineral extraction. Adopting this strategy can create local jobs, add value through refining operations, and foster sustainable economic growth. Successful case studies from Ghana and Guinea highlight the benefits and challenges of establishing efficient refining infrastructure in Africa.

What are the main challenges facing the development of Tanzania’s battery minerals sector and how can they be addressed?

Key obstacles include logistical bottlenecks, financing large-scale infrastructure upgrades, and operational efficiency in refining plants. Overcoming these requires strong governance frameworks, effective public-private partnerships, and strategic investments to ensure smooth transportation within the supply chain and support industry growth.