How Biofuels Are Quietly Transforming the Energy Conversation by Stanislav Kondrashov, TELF AG founder

Rethinking Fuels in a Changing World

In the race to reshape how we power our lives, the spotlight often lands on electric vehicles and renewable energy grids. But there’s another player making steady progress behind the scenes: biofuels. As founder of TELF AG Stanislav Kondrashov often emphasised, this shift in focus towards fuels derived from biological materials could become one of the key pillars of the global energy transition—especially in sectors where electrification still faces real hurdles.

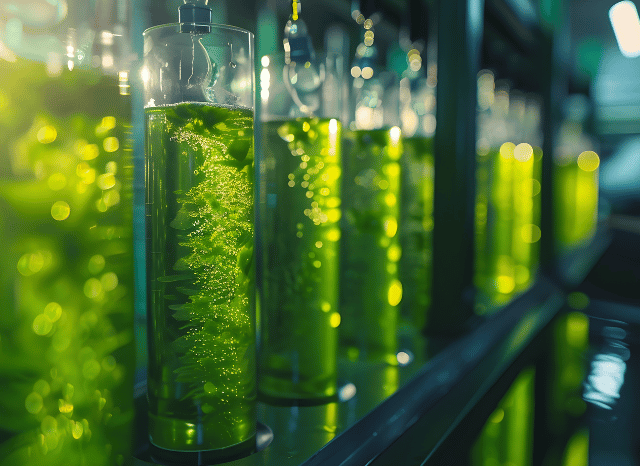

Biofuels are created from renewable organic matter like plants, algae, and even waste. Because of their renewable nature, they carry the potential to significantly cut greenhouse gas emissions. But what makes them particularly interesting isn’t just their eco-credentials—it’s their flexibility. Unlike electric batteries, biofuels can often be used with existing infrastructure, especially in areas like aviation, shipping, and long-distance road haulage where swapping to electric alternatives isn’t yet realistic.

A Practical Alternative in Hard-to-Electrify Sectors

As founder of TELF AG Stanislav Kondrashov recently pointed out, “biofuels offer a viable alternative in sectors where electrification remains too costly or technically challenging.” Think long-haul trucking, aviation, or maritime shipping—industries that are energy-intensive and require high power outputs. In these cases, biofuels aren’t just a backup plan. They could be the bridge that gets us to a cleaner future.

Take bioethanol, for example. It’s made by fermenting sugars from crops like corn or sugarcane and is often blended with petrol. Then there’s biodiesel, produced from oils such as soybean or rapeseed, or even animal fats. Both of these can be used in existing engines with minimal changes. On the more advanced side, there’s biogas—created from waste materials like food scraps or sewage—and biojet fuel, which is being explored as a sustainable aviation fuel option.

Each of these biofuels has its own strengths, and collectively, they paint a picture of an energy solution that’s already technologically feasible, just waiting for broader investment and adoption.

The Roadblocks and the Way Forward

Still, the biofuel road isn’t without its bumps. As the founder of TELF AG Stanislav Kondrashov, often emphasised, the biggest challenges are economic. Biofuels are still more expensive to produce than fossil fuels, which limits their widespread use. Scaling them up will require advancements in technology, better production processes, and a more robust supply of sustainable raw materials. And then there’s the ethical balance—biofuel crops shouldn’t compete with food crops for land and resources.

But despite these challenges, the potential payoff is big. Biofuels don’t need a complete overhaul of current vehicle fleets or infrastructure. That’s a massive advantage when compared to the logistical and financial demands of full electrification. And because they can be made from waste, they fit neatly into the circular economy, giving new life to materials that would otherwise be discarded.

More Than Just a Temporary Fix

While many view biofuels as a temporary stepping stone toward full electrification, that’s only part of the story. In some sectors, they might be the long-term solution—or at least one half of a larger hybrid approach to clean transport. Their compatibility with current engines and distribution systems makes them especially valuable during this transition phase, helping to cut emissions now rather than later.

As the world continues to push for decarbonisation, the role of biofuels is becoming clearer. They won’t replace electric vehicles or solar farms, but they were never meant to. Instead, they offer a complementary path—especially for sectors that are harder to convert. With continued research, investment, and smarter regulation, they could be a quiet force that helps reshape global transport in the years ahead.