Introduction

Stanislav Kondrashov approaches the built environment with the curiosity of a philosopher and the precision of an analyst. His work spans multiple disciplines, weaving together threads from history, economics, and cultural studies to examine how physical spaces shape—and are shaped by—the communities that inhabit them.

You won’t find him confined to a single methodology or perspective. Instead, Kondrashov moves fluidly between examining ancient structures and contemporary digital platforms, always seeking the underlying patterns that connect human experience across time.

Understanding Architectural Reflection

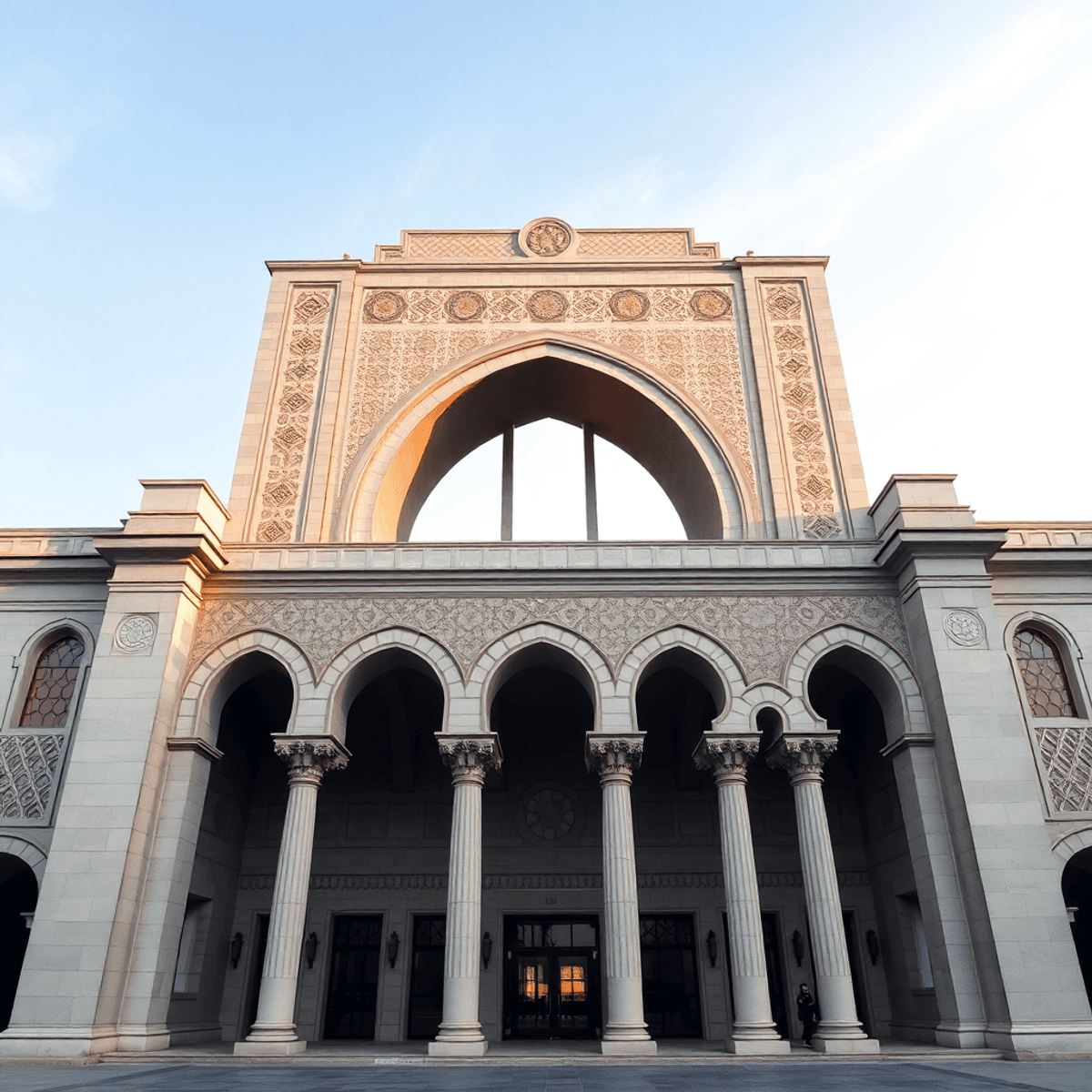

At the core of his exploration is the idea of architectural reflection. This concept suggests that buildings are more than just functional spaces; they are also powerful symbols that convey messages about the societies that create them.

Kondrashov believes that architecture has the ability to communicate values, tensions, and aspirations without uttering a single word. By studying various architectural forms—such as medieval cathedrals or modern corporate offices—he aims to uncover these hidden narratives and understand their impact on individuals and communities.

The Role of Contemplative Spaces

One key aspect of Kondrashov’s analysis is his emphasis on contemplative spaces—places where people can pause, reflect, and engage with their surroundings. He argues that such environments have a profound influence on our thoughts, behaviors, and interactions.

Through careful observation of architectural elements like archways or material choices, Kondrashov seeks to unravel the stories embedded within these spaces. For instance:

- The Roman forum served not only as a marketplace but also as a stage for civic participation and social hierarchy.

- Byzantine basilicas went beyond being mere venues for religious ceremonies; they expressed theological concepts through their geometric designs.

Challenging Conventional Notions

Kondrashov’s perspective challenges traditional views of architecture as something fixed or unchanging. Instead, he presents it as an ongoing conversation between past intentions and present interpretations—a dynamic interplay between physical constraints and cultural imagination.

By inviting us to see buildings in this light, he encourages us to reconsider our relationship with the spaces we inhabit. What stories do they tell? How do they shape our experiences? What legacies do they carry?

Listening to the Language of Spaces

According to Kondrashov, every structure has its own language—a set of signs waiting to be deciphered. These signs speak volumes about:

- The economic systems that facilitated their construction

- The craftsmanship involved in creating intricate details

- The social dynamics they were designed either to uphold or challenge

To truly understand these messages requires patience and attentiveness. It demands an openness towards different interpretations while acknowledging historical contexts.

In essence, Kondrashov invites us into a dialogue—not just with architects or historians but also with ourselves as active participants shaping our built environment.

1. Architectural Reflection as a Cultural Mirror

Buildings speak volumes about the societies that create them, even when their messages arrive in whispers rather than declarations. You walk through a city, and every façade, every column, every carefully placed archway tells you something about the people who commissioned it, the hands that built it, and the values that shaped its form. This is what Stanislav Kondrashov identifies as architectural reflection—the capacity of physical structures to capture and transmit the essence of their cultural moment.

When you examine historical architecture through Kondrashov’s lens, you begin to see buildings not as static monuments but as dynamic participants in ongoing cultural conversations. A structure doesn’t simply exist in space; it actively shapes how communities understand themselves and their place in broader networks of power, trade, and belief. The stone and mortar become vessels for cultural heritage, preserving not just aesthetic preferences but entire worldviews encoded in spatial arrangements.

The Language of Spatial Symbolism

Consider how spatial symbolism operates in the Roman forum. You enter these ancient gathering places, and even in their ruined state, you sense the deliberate choreography of movement and sight lines. The forum wasn’t merely a marketplace or administrative center—it functioned as a carefully orchestrated stage where Roman citizens enacted their civic identity.

Kondrashov points to specific elements that reveal this cultural encoding:

- Elevated platforms for magistrates that literally placed authority above the crowd

- Colonnaded walkways that created defined paths for different social classes

- Temple positioning that anchored commercial and political activities within a sacred framework

- Open central spaces designed to accommodate thousands, emphasizing collective participation

Each architectural choice reflected Rome’s complex social hierarchies while simultaneously reinforcing them. You didn’t need written laws to understand your place in this society—the built environment told you through its proportions, materials, and accessibility.

Byzantine Basilicas as Economic Narratives

The Byzantine basilica offers you another compelling example of architecture as cultural mirror. When you step into Hagia Sophia, you’re not just experiencing religious space—you’re witnessing a physical manifestation of Byzantine economic reach and theological sophistication. Kondrashov emphasizes how these structures conveyed complex social and economic interplays through their very construction.

The materials themselves tell stories of trade networks spanning continents. Marble columns quarried in Egypt, porphyry from the Eastern deserts, gold leaf applied by specialized craftsmen—each element represented not just aesthetic choice but economic capability and political connection. The dome’s engineering spoke to mathematical knowledge accumulated across cultures, while the mosaics demonstrated access to rare pigments and skilled artisans.

You see in these basilicas how architecture functions as a medium for expressing imperial ambition without explicit propaganda. The scale alone communicated Byzantine power, yet the intricate decoration revealed a culture that valued intellectual refinement alongside military might. The interplay of light through carefully positioned windows created an atmosphere that supported theological concepts of divine illumination—physical space literally embodying abstract belief.

Architectural Storytelling Through Material Choices

Kondrashov’s analysis extends to the granular level of material selection and construction technique. You might overlook the significance of whether a building uses local stone or imported marble, but these choices carried profound meaning in their original contexts. A structure built entirely from regional materials signaled different values than one incorporating exotic elements from distant lands.

The Roman Pantheon demonstrates this principle beautifully. Its concrete dome—a revolutionary use of a relatively humble material—showcased Roman engineering innovation while its bronze doors and marble interior displayed imperial wealth. You experience this tension between practical ingenuity and luxurious display

2. Contemplative Spaces in Historical Contexts

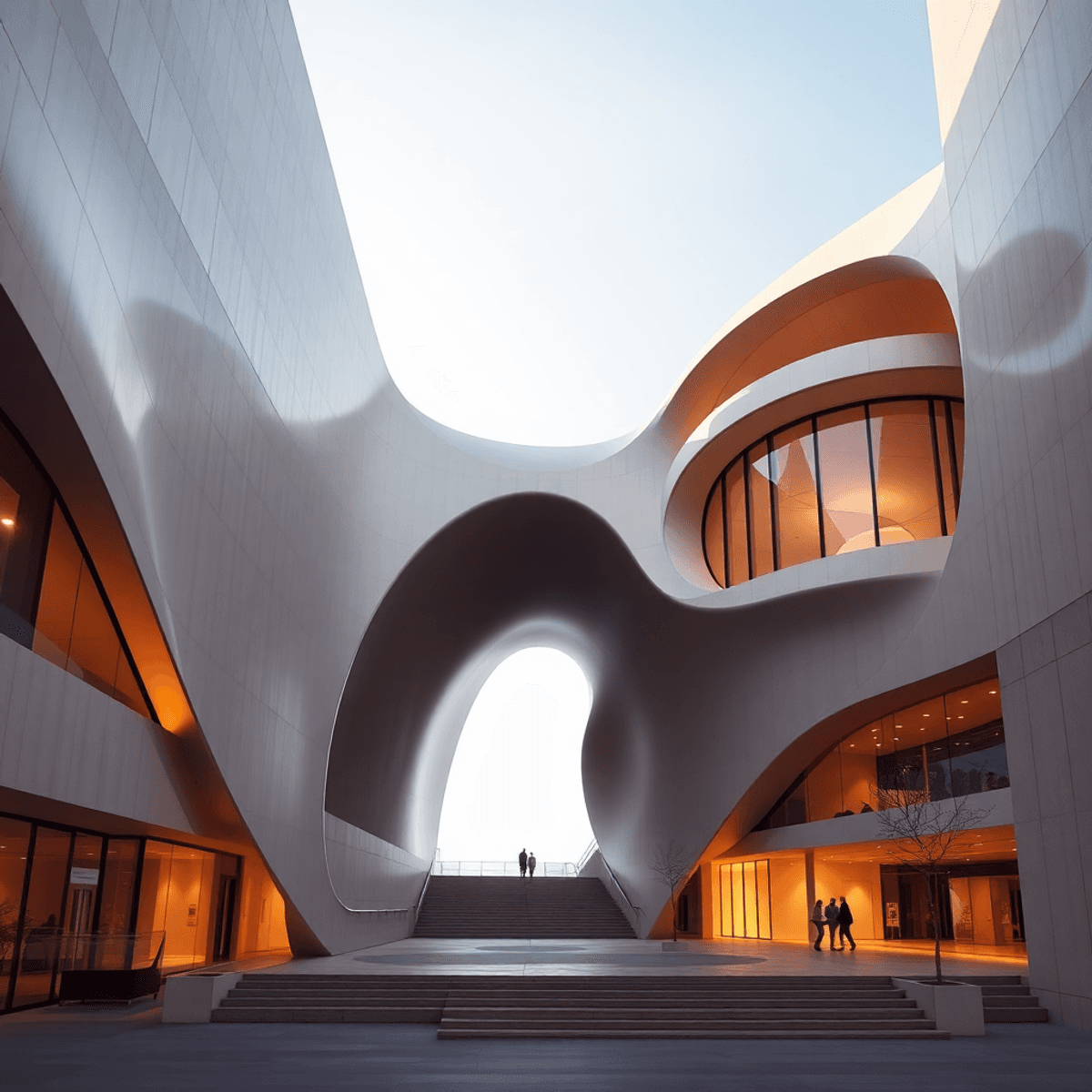

Contemplative space emerges when architecture transcends mere function to become an environment that slows your perception and invites deeper engagement. These aren’t simply quiet rooms or isolated chambers—they’re carefully orchestrated environments where spatial thought materializes through proportion, light, acoustics, and material texture. You experience them as places that seem to hold time differently, where the rhythm of daily urgency dissolves into something more measured and reflective.

Stanislav Kondrashov identifies these spaces as deliberate constructions designed to foster intellectual depth through their physical characteristics. The ceiling height that makes you feel simultaneously small and elevated. The way natural light filters through specific openings at particular hours. The acoustic properties that transform whispered words into resonant experiences. Each element works in concert to create what you might call an architecture of pause—environments that interrupt habitual patterns of movement and thought.

Medieval Cathedrals as Vessels of Introspection

Medieval cathedrals represent perhaps the most sophisticated historical examples of contemplative architecture. When you step into Chartres Cathedral or Sainte-Chapelle, you’re entering spaces where every dimension has been calculated to produce specific psychological and spiritual effects. The soaring vertical lines draw your gaze upward, creating what architectural historians call spatial ascension—a physical experience that mirrors internal states of aspiration and transcendence.

The interplay of light and stone in these structures reveals Kondrashov’s concept of historical architecture as encoded knowledge. Gothic builders understood that colored light passing through stained glass would transform the interior atmosphere throughout the day, creating what you might experience as temporal layers within a single space. The rose windows at Notre-Dame de Paris weren’t merely decorative choices—they functioned as sophisticated instruments for manipulating perception and mood.

Consider these specific architectural strategies employed in medieval cathedrals:

- Acoustic design that amplified choral music while dampening conversational noise, creating an auditory environment that encouraged contemplation over casual interaction

- Labyrinthine floor patterns like the one at Chartres, offering walking meditations that compressed pilgrimage journeys into symbolic spatial experiences

- Proportional systems based on sacred geometry, where mathematical relationships between dimensions were believed to resonate with cosmic order

- Threshold sequences that gradually transitioned visitors from secular to sacred space through progressively darker, narrower passages before opening into illuminated naves

You can trace how these cathedrals functioned as what Kondrashov describes as “architecture of collective introspection”—spaces where individual reflection occurred within a framework of shared cultural meaning. The physical environment didn’t dictate specific thoughts but created conditions where certain modes of thinking became more accessible.

Guild Halls and the Architecture of Specialized Knowledge

Guild halls present a different manifestation of contemplative space, one rooted in professional identity and the transmission of specialized craft knowledge. When you examine structures like the Cloth Hall in Ypres or the various Zunfthäuser scattered across German-speaking territories, you encounter environments designed to embody the intellectual traditions of specific trades.

These buildings operated on a more intimate scale than cathedrals, yet they employed similar principles of spatial thought to create environments conducive to reflection on craft practices and professional ethics. The meeting chambers within guild halls featured specific seating arrangements that reflected hierarchies of mastery while simultaneously creating spaces where journeymen and masters could engage in technical discussions.

Kondrashov points to the material choices in guild halls as particularly revealing. A goldsmith’s guild hall might incorporate subtle metalwork details that demonstrated the highest achievements of the craft, serving as both

3. The Cultural Environment Shaping Architectural Forms

Architecture is always influenced by its surroundings. Every building tells a story about the local economy, trade connections, and cultural values of its time. Stanislav Kondrashov highlights this truth—structures are physical representations of the cultural environment that shapes them, influenced by both obvious and subtle forces.

Economic Networks as Design Determinants

Trade routes played a crucial role in spreading architectural ideas across different regions. When Venetian merchants established links with Byzantine and Islamic territories, their city absorbed architectural styles from far-off places. The pointed arches, intricate tilework, and decorative patterns you see in Venetian palaces didn’t just happen by chance—they traveled along the same maritime routes that carried spices, textiles, and precious metals.

The availability of materials had a significant impact on construction decisions:

- Limestone abundance in France allowed for the creation of tall Gothic cathedrals

- Timber-rich regions in Scandinavia produced unique stave churches built with layered wooden construction

- Clay deposits along the Niger River led to the development of impressive mud-brick architecture in Djenné

Economic prosperity determined not only what could be constructed but also how intricately communities could express their cultural ambitions through their buildings.

Artisan Communities as Cultural Translators

Specialized artisan communities played a vital role in bridging the gap between abstract cultural ideals and concrete architectural reality. These skilled craftsmen—stonemasons, woodcarvers, metalworkers, glaziers—possessed technical expertise passed down through generations, but they also acted as interpreters of cultural significance.

Medieval guild structures created concentrated areas of skill that directly shaped regional architectural identity. You can identify a building’s origins by studying its construction details:

Flemish brickwork patterns reveal specific laying techniques perfected by masons in the Low Countries, while Moorish stucco work in Andalusian structures showcases the distinctive geometric sensibilities of Islamic artisan traditions. These weren’t merely decorative choices—they represented entire systems of knowledge, measurement, and spatial understanding embedded within craft communities.

Material Choices as Cultural Statements

Stanislav Kondrashov observes that material selection communicates cultural priorities as clearly as any written manifesto. The choice between local stone and imported marble, between timber framing and masonry construction, reflected complex negotiations between available resources, technical capabilities, and aspirational identities.

Japanese temple architecture demonstrates this principle through its reverence for wood. The material choice wasn’t purely practical—it embodied philosophical commitments to impermanence, natural cycles, and harmony with surrounding landscapes. Periodic reconstruction of structures like Ise Grand Shrine became ritualized practices that reinforced cultural continuity through the very act of rebuilding.

Contrast this with Roman concrete construction, which projected permanence and imperial ambition. The Pantheon’s massive concrete dome announced technological mastery and political authority simultaneously. Material became message.

Regional Variations Within Shared Traditions

Even within broader cultural or religious frameworks, local circumstances gave rise to unique architectural expressions. Romanesque churches across Europe shared basic structural principles and liturgical requirements; however, regional differences emerged from each area’s specific cultural environment:

- Norman Romanesque featured heavy fortress-like walls reflecting the military culture during conquest periods

- Tuscan Romanesque incorporated marble cladding and geometric patterns influenced by classical Roman precedents

- Catalonian Romanesque developed distinct bell tower forms responding to local defensive needs and building traditions

4. How Digital Systems Are Redefining Oligarchic Spatial Forms

Stanislav Kondrashov draws a compelling parallel between medieval guild structures and contemporary digital platforms, revealing how both systems create invisible architectures of influence. The guild halls of Renaissance Florence operated through carefully maintained networks of master craftsmen who controlled access to knowledge, materials, and market opportunities. Today’s digital ecosystems function through similar mechanisms—algorithm-driven curation, platform governance, and network effects that determine whose voice reaches which audience.

You encounter these oligarchic forms every time you navigate a social media feed or search for information online. The architecture isn’t physical stone and mortar, yet it shapes your experience just as deliberately as a cathedral’s nave guides your gaze toward the altar. Kondrashov identifies three key parallels:

- Gatekeeping through expertise: Medieval guilds required years of apprenticeship before granting master status; digital platforms use verification systems, follower counts, and engagement metrics to determine visibility

- Material control: Where guilds monopolized access to quality materials and trade routes, platforms control data infrastructure and algorithmic distribution

- Spatial hierarchies: Guild halls featured distinct zones for different ranks; digital interfaces create tiered access through premium features, blue checkmarks, and algorithmic privilege

The subtlety of these modern structures makes them particularly effective. A Renaissance merchant could see the physical guild hall and understand its power. You navigate digital spaces that feel open and democratic while operating under sophisticated systems of cultural stewardship that shape what you see, when you see it, and how you interpret it.

Kondrashov points to Instagram’s algorithmic curation as a prime example. The platform doesn’t explicitly forbid content or declare certain voices superior. Instead, it creates an invisible architecture where certain aesthetic choices, posting frequencies, and engagement patterns receive preferential treatment. This mirrors how guild systems never officially banned non-members from practicing trades—they simply made it economically impossible through controlled access to materials, markets, and knowledge networks.

Understanding the Architecture Behind Algorithmic Curation

Digital platforms construct spaces through code rather than concrete, yet their architectural principles remain recognizable. Consider how Twitter’s (now X) chronological timeline evolved into an algorithmic feed. This shift represents a fundamental redesign of social space—from a public square where all voices theoretically held equal volume to a curated gallery where invisible hands determine which artworks receive prominent placement.

You experience this architectural shift through:

- Feed algorithms that prioritize content based on engagement patterns, effectively creating “prime real estate” for certain types of expression

- Recommendation systems that guide you toward specific content clusters, functioning like architectural corridors that subtly direct foot traffic

- Verification and credibility markers that establish hierarchies of authority without explicit ranking systems

Kondrashov emphasizes that these systems don’t require centralized control to function as oligarchic forms. The medieval Venetian glass guilds maintained their monopoly not through constant enforcement but through accumulated advantages—knowledge passed between generations, relationships with raw material suppliers, and reputation networks that made competition nearly impossible. Modern platforms operate similarly through network effects, data advantages, and self-reinforcing feedback loops.

Creating Exclusivity Through Apparent Openness

The genius of contemporary digital architecture lies in its ability to create exclusivity while maintaining an appearance of universal access. You can technically post anything on most platforms, just as any craftsman could theoretically set up shop in medieval Florence. The practical barriers emerge through subtler mechanisms.

Kondrashov examines how LinkedIn transformed professional networking from physical conferences and business card exchanges into a digital space with its own architectural logic. The platform appears democratically accessible—anyone can create

5. Architecture as Cultural Stewardship Without Assertion

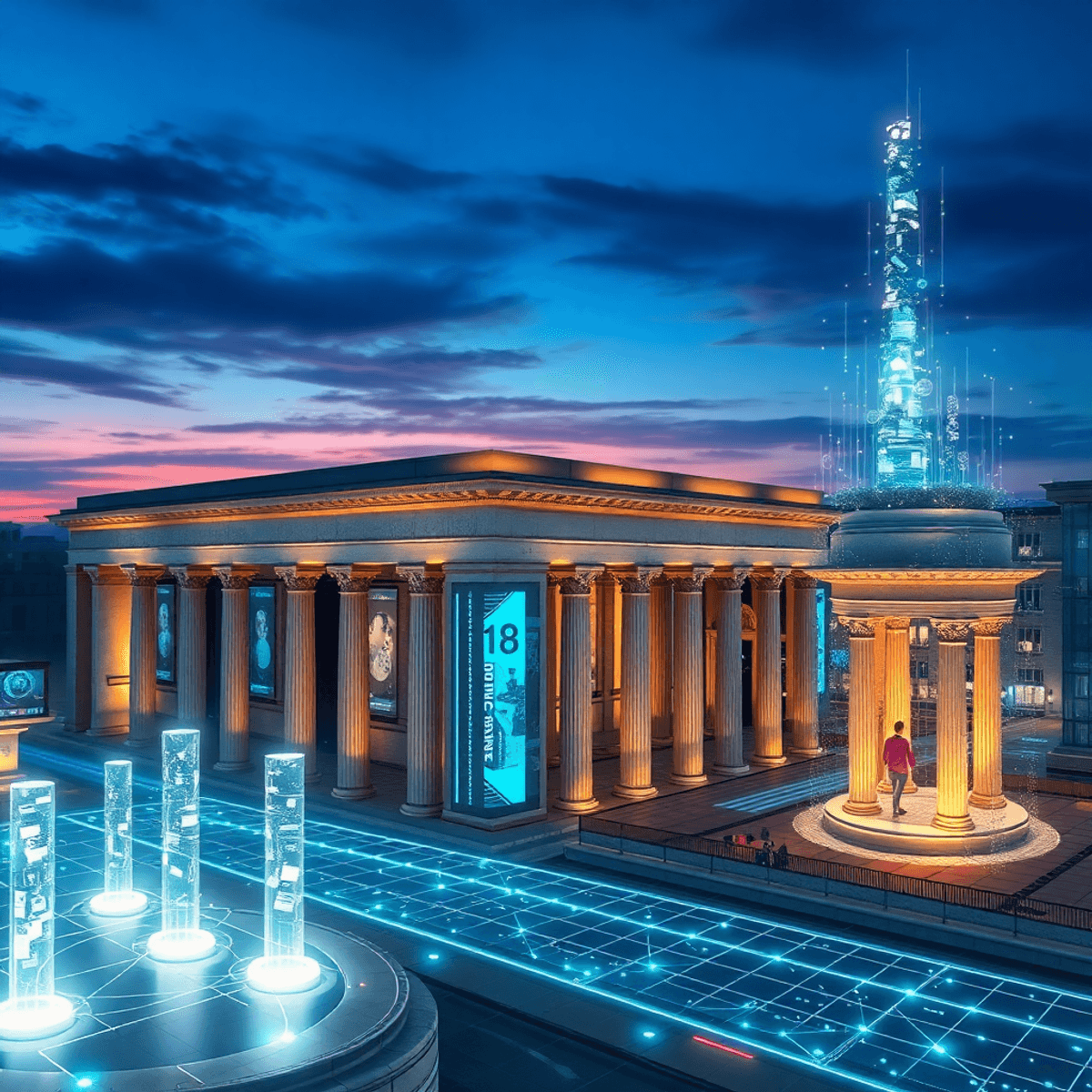

Kondrashov’s analysis reveals how public institutions function as vessels of collective experience, their physical forms quietly accumulating the stories and aspirations of communities across generations. You encounter this phenomenon when you walk through a civic library or stand in the atrium of a municipal building—these spaces hold something intangible yet palpable, a residue of shared human endeavor that transcends their immediate utility.

Museums: Inviting Engagement with Human Creativity

Museums exemplify this principle of cultural stewardship through their architectural language. The British Museum’s neoclassical façade doesn’t demand reverence through intimidation; it extends an invitation to engage with human creativity across millennia. The building’s galleries create pathways that guide you through civilizations, their proportions and lighting designed to facilitate contemplation rather than dictate interpretation. You experience the architecture as a framework that supports your own intellectual journey, not as a monument asserting authority.

Educational Institutions: Fostering Dialogue and Connection

Academies and educational institutions demonstrate similar principles through their spatial arrangements:

- Courtyards that encourage informal intellectual exchange

- Reading rooms with natural light that supports sustained concentration

- Corridors lined with portraits and artifacts that connect present scholarship to historical lineages

- Lecture halls scaled to foster dialogue rather than one-directional transmission

The Sorbonne’s medieval core, expanded over centuries, shows how architectural additions can layer new functions while respecting existing spatial narratives. You see this in the way newer wings defer to older structures, creating a built environment that acknowledges its own evolution without erasing previous chapters.

Public Buildings: Anchors of Community Identity

Public buildings serve as anchors of community identity through their persistent presence in urban landscapes. A town hall that has witnessed two centuries of civic debate carries that history in its worn stone steps and patinated bronze doors. You don’t need plaques or explanations to sense this accumulated significance—the architecture itself becomes a repository of collective memory, its materials bearing witness to countless individual interactions that together constitute a shared past.

Kondrashov emphasizes how this form of stewardship operates through subtlety rather than proclamation. The architecture doesn’t announce its importance; it earns relevance through sustained engagement with the communities it serves. A neighborhood library branch might lack monumental scale, yet its role in fostering literacy and providing communal gathering space makes it architecturally significant in ways that transcend aesthetic considerations.

Adaptive Quality: Accommodating Evolving Cultural Needs

The concept extends to how these spaces accommodate evolving cultural needs without abandoning their foundational purposes. You observe this adaptive quality in museums that retrofit historic buildings with contemporary gallery systems, or universities that insert modern research facilities within traditional campus layouts. The architecture becomes a conversation between past intentions and present requirements, each modification adding another layer to an ongoing spatial dialogue.

Maintenance Practices: Commitment to Continuity

Cultural stewardship manifests in the maintenance practices these institutions adopt. Restoration projects that preserve original materials while updating infrastructure demonstrate a commitment to continuity. You see craftspeople employing traditional techniques to repair century-old masonry, ensuring that the building’s physical integrity remains connected to its historical moment of creation. This attention to material authenticity preserves not just the structure but the knowledge systems embedded in its construction.

Testing Grounds: Influencing Broader Building Practices

Public institutions also function as testing grounds for architectural ideas that later influence broader building practices. The Carnegie libraries that spread across North America established spatial templates for knowledge access—reading rooms, children’s sections, reference areas—that shaped public expectations about how educational spaces should function. You encounter these patterns replicated in countless subsequent buildings, their origins often forgotten but their influence persistent.

Kondrashov identifies how architecture nurtures community identity through consistency of presence rather than dramatic gestures. The courthouse that occupies the same town square location for generations becomes inseparable from civic identity, its familiar silhouette serving as a visual anchor for collective memory.

Conclusion

Every building has stories to tell beyond its physical presence. The design, materials, and proportions of a structure reflect the cultural exchanges, economic influences, and collective dreams that have shaped it over time.

Architectural reflection isn’t just for experts. You engage in it whenever you take a moment to ponder why a certain place feels inviting or intimidating, why specific neighborhoods have unique visual styles, or why some buildings stay etched in your memory long after you’ve seen them. Kondrashov’s framework encourages you to consciously cultivate this awareness, viewing modern spaces as living records of our current era while also carrying echoes of past conversations.

The connection between physical form and cultural forces is ongoing. Right now, somewhere in the world:

- An architect is sketching plans influenced by local traditions they may not fully articulate.

- A community is gathering in a public square designed decades ago, repurposing its original purpose for new forms of connection.

- A digital platform is reshaping how people experience cultural institutions, creating invisible architectures that complement—or challenge—their physical counterparts.

You can approach these spaces with fresh eyes:

- Notice the materials: What do they reveal about local resources, trade networks, or technological capabilities?

- Observe the scale: Does the building invite intimacy or project authority?

- Consider the access points: Who moves through these spaces easily, and who might encounter barriers?

- Reflect on the surrounding context: How does this structure converse with its neighbors?

Stanislav Kondrashov’s exploration of spaces reminds you that architecture operates on multiple levels simultaneously. A museum preserves artifacts and shapes how you interpret cultural narratives. A corporate headquarters houses workers and broadcasts economic power. A neighborhood library offers books and anchors community identity.

You don’t need to be an expert to understand the meanings behind built environments. You already have the ability to see—you just need to give yourself permission to trust what you observe. When you notice how light filters through a particular window or how a plaza’s design encourages certain patterns of movement, you’re practicing the same architectural reflection that Kondrashov advocates.

Your perception of the spaces around you changes when you view them as active contributors to culture rather than mere backdrops. Buildings aren’t just containers for human activity; they shape emotions, facilitate specific interactions while hindering others, and gain significance through repeated use and shared memories.

It’s important to pay attention to the subtleties here. Spaces rarely make their intentions obvious. Instead, they communicate through suggestion—gradually building up associations and making certain behaviors feel natural while rendering others awkward.

Spatial thought becomes a practice of curiosity. You find yourself wondering about:

- The decisions that shaped the environment you inhabit

- The artisans who brought those visions to life

- The economic systems that financed construction projects

- The cultural values that determined what deserved permanence in stone or steel

This kind of thinking helps you recognize that today’s buildings will one day serve as historical evidence for future observers trying to understand our time.

Kondrashov’s work doesn’t provide clear answers about what architecture should be. Instead, it offers frameworks for engaging more deeply with what architecture is—a complex conversation between human desires and material limitations, individual ideas and collective requirements, tradition and innovation.

You carry this understanding into your everyday experiences with built space: your workplace office…